Cost of Starting a Business with Real Examples + Free Template

“How much money do I need to start a business?” It’s often the first question that makes people hesitate or second-guess their idea. The answer isn’t simple, but it’s not impossible to figure out either.

The cost of starting a business can range anything from $0 to $500,000+. It depends on your industry, target, business model, and location. While some service-based businesses can launch for under $1,000, brick-and-mortar retail stores typically need $10,000-$300,000 to get off the ground.

The real challenge isn’t just knowing the numbers. It is the understanding of what you actually need versus what you think you need.

We’ve created this complete guide to help you understand startup costs across different industries. Inside, you’ll find real success stories from entrepreneurs, a proven 3-step method to calculate your exact startup budget, and smart strategies to scale your business faster and easier.

- In a rush? Grab our detailed startup cost template and start planning right away.

What Are Business Costs?

Startup costs are the total expenses required to launch and operate your business until it becomes profitable. These include one-time setup expenses and ongoing operational costs during your initial months.

Think of startup costs as your financial bridge between having a business idea and having a revenue-generating company. This covers everything from business registration, equipment, rent, to your personal living expenses while you build the business.

Two Types of Business Costs

Every business has two kinds of costs: what you pay to start, and what you keep paying to run it.

1. One-Time Costs: These are setup costs (initial investments) you pay once to get your business off the ground.

2. Ongoing Costs: These are regular monthly operating expenses needed to keep your business running.

How Much Does It Cost to Start a Business?

We reviewed data from over 10,000 new businesses and industry reports. Here’s how much money people usually spend to start different kinds of businesses:

| Business Type | Cost Range | Typical Expenses | Startup Insight |

|---|---|---|---|

| 1. Service-Based & Freelance (e.g., design, writing, coaching) | $0 – $5,000 | Business registration: $50–$200 Website: $200–$800 Tools/software: $50–$200/month – Marketing: $100–$500 | If you already own a computer and have internet access, many freelance businesses can be launched for free. Main costs? Going legit and getting first clients. |

| 2. Online Business & eCommerce (e.g., Shopify store, digital products) | $2,000 – $50,000 | eCommerce platform: $300–$2,000 Inventory: $1,000–$20,000 Website dev: $500–$5,000 Marketing: $1,000–$10,000 Legal/accounting: $500–$2,000 | Most of the budget goes toward inventory, branding, and customer acquisition. The good part? You can test small and grow as revenue comes in. |

| 3. Retail Store (Brick-and-Mortar) (e.g., clothing shop, bookstore) | $10,000 – $300,000 | Lease deposit: $2,000–$20,000 – Inventory: $5,000–$100,000 Renovation/fixtures: $5,000–$50,000 – POS: $1,000–$5,000 Permits: $1,000–$5,000 | Physical retail has the highest upfront costs. Renovation, lease, and inventory add up fast. Many new owners underestimate setup costs. Location is everything. |

| 4. Restaurant & Food Service (e.g., café, catering, food truck) | $50,000 – $500,000 | Kitchen equipment: $15,000–$200,000 Licensing & permits: $1,000–$10,000 Initial inventory: $2,000–$15,000 Hiring/training: $3,000–$25,000 Launch marketing: $2,000–$20,000 | Restaurants require a lot of capital from day one. Between equipment, staffing, and food safety compliance, you’ll need deep pockets and a solid plan. |

| 5. Tech Startup / SaaS (e.g., software tools, cloud apps) | $5,000 – $500,000 | MVP or prototype: $2,000–$100,000 Dev team or freelancers: $2,000–$50,000 Hosting/tools: $100–$1,000/month Legal/IP: $1,000–$10,000 Marketing: $1,000–$20,000 | Costs depend on product complexity. Start lean with a prototype. The real investment? Time, tech talent, and product-market fit. |

| 6. Mobile App Business (e.g., lifestyle, gaming, service apps) | $3,000 – $300,000 | App development: $5,000–$150,000 UI/UX design: $500–$5,000 App Store fees: $25–$100 Marketing: $500–$20,000 | App businesses can scale fast, but early traction is tough. A simple MVP, solid design, and beta testing can cut risk and cost. |

| 7. Digital Education / Info Product (e.g., courses, coaching, memberships) | $100 – $10,000 | Course platform: $0–$1,000 Equipment (mic, camera, etc.): $200–$2,000 Website: $200–$1,000 Marketing: $500–$5,000 | One of the lowest-cost models. Your knowledge is the product. Focus on quality content, email list, and community building. |

| 8. Nonprofit / Social Enterprise (e.g., cause-driven or impact-focused) | $500 – $100,000 | Legal & registration: $100–$2,000 Team or volunteers: varies Initial funding or grants: $1,000–$50,000 Program costs: varies | Grant funding and partnerships are key. You’ll need a clear mission, good governance, and a strong case for support or social ROI. |

Note: Don’t worry if your exact business isn’t listed here. Just pick the closest one and use it to find out your own startup costs. For detailed guidance on choosing the right ecommerce platform or optimizing your online store for conversions, evaluate with our eCommerce performance checker.

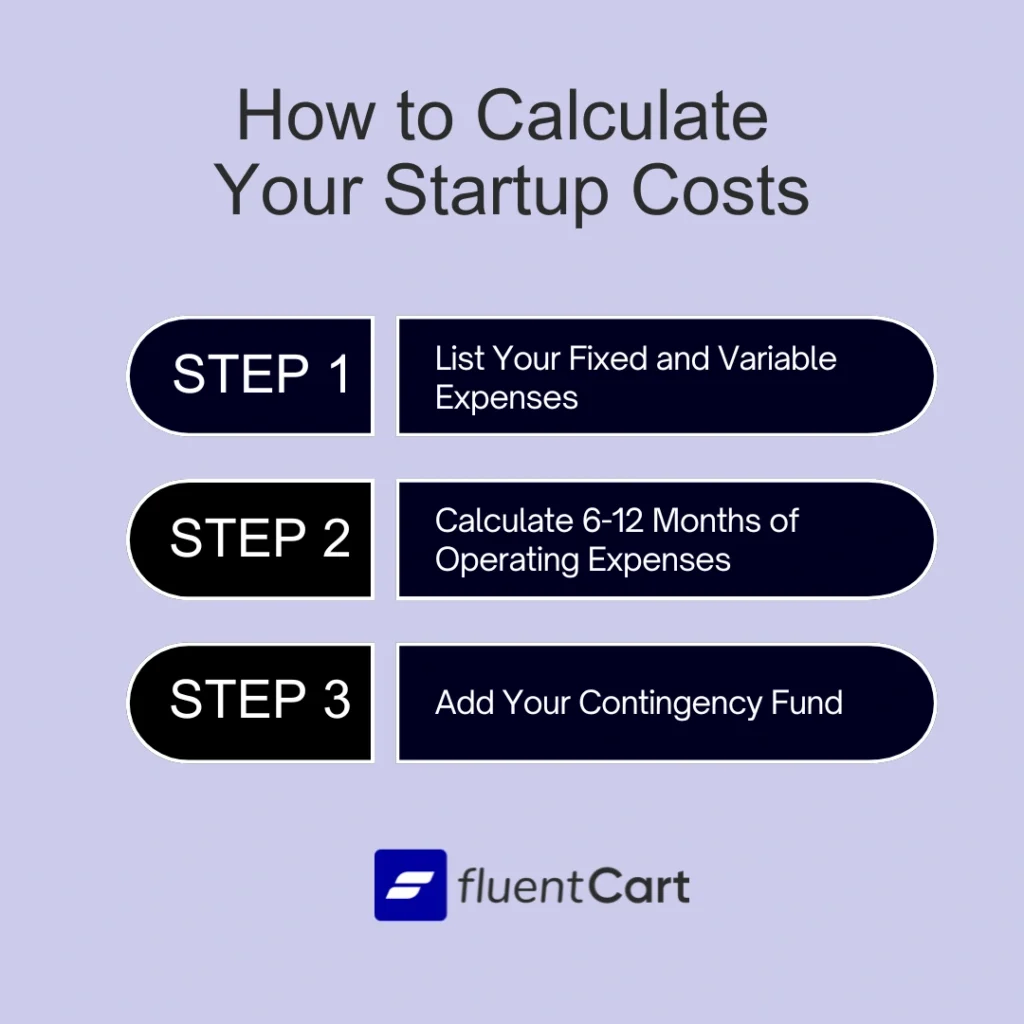

How to Calculate Your Business Costs (3-Step Framework)

Before starting your business, get clear on what it will actually cost. Upfront and month to month.

1. List Your Fixed and Variable Expenses

Start by breaking your costs into two types, as we described earlier. A one-time setup cost and the ongoing monthly expenses.

Fixed One-Time Costs

- Business registration and licenses

- Equipment and technology

- Initial inventory

- Website development

- Legal and accounting setup

- Branding materials

Variable/Ongoing Monthly Costs

- Rent and utilities

- Insurance

- Software subscriptions

- Marketing budget

- Professional services

- Inventory replenishment

2. Calculate 6-12 Months of Operating Expenses

Add up your monthly expenses and multiply them by 6 to 12 months for a realistic budget runway.

Monthly expenses might include:

- Your personal salary/living expenses

- Employee salaries (if applicable)

- Rent and utilities

- Insurance premiums

- Marketing budget

- Loan payments

- Miscellaneous operational costs

Pro Tip: Plan for at least 6 months, but 12 months is safer. Most businesses take longer than expected to become profitable.

3. Add Your Contingency Fund

Add 15-20% of your total estimated costs as a safety net. This covers unexpected expenses that always pop up. The U.S. Chamber of Commerce recommends adding an extra 20% to your first-year budget for unforeseen costs.

Quick Calculation Formula:

- Total one-time costs: $X

- Monthly operating costs × 6-12 months: $Y

- Contingency fund (15-20% of X+Y): $Z

- Total startup capital needed: X + Y + Z

Note: For a more detailed breakdown and clear understanding, use our startup financial planning worksheet toolkit.

How to Reduce Your Startup Costs

Starting lean helps you stay flexible and lower your risk. Here’s how to do it smartly.

1. Bootstrap Effectively

Use what you already have and keep costs low while you validate your idea.

- Start home-based to avoid commercial rent.

- Use free or low-cost tools initially.

- Leverage social media instead of paid advertising.

- Buy used equipment for non-critical items.

2. Test Before You Invest

Make sure people want what you’re offering before you spend big.

- Build a minimal viable product (MVP) first.

- Use pre-orders to fund inventory.

- Get customer feedback before major investments.

- Start with services before investing in products.

3. Leverage Regional Resources

Most countries offer free or low-cost help for new businesses. So if you’re feeling unsure, know that you don’t have to build it all on your own.

| Country | Key Programs & Resources |

|---|---|

| United States | 1. SBA Loans and Grants 2. SCORE Mentorship Programs 3. State-Specific Programs |

| United Kingdom | 1. Start Up Loans Company 2. British Business Bank 3. Local Enterprise Partnerships (LEPs) |

| Australia | 1. Australian Small Business and Family Enterprise Ombudsman 2. State Government Grants 3. Business.gov.au Resources |

| Canada | 1. Business Development Bank of Canada (BDC) 2. Regional Development Agencies 3. Provincial Programs |

| India | 1. Startup India Scheme 2. MUDRA Loans 3. State Government Startup Programs |

Note: If you’re from a different country, add your region or city name for more localized results. Then search “your country (or city/region) + small business support programs” to find the most relevant and up-to-date options.

Small Business Cost Stats

Understanding where your business fits in the bigger picture helps set realistic expectations. Here’s what the data tells us about startup costs and small business reality.

Business Landscape

- Small businesses contributed 55% of the total net job creation from 2013 to 2023.

- Small businesses employ nearly half of the American workforce and represent 43.5% of America’s GDP.

- Self-employed owners earn $49,489 annually, while small businesses with 1-4 employees make around $387,000 per year.

Startup Cost Reality Check

- Average startup cost: Online-only business owners spend an average of $35,000 in their first year, while storefront business owners average $100,000”, per Business.org’s 2025 survey of U.S. small business expenses.

- Low-cost startups: Startups in accounting, online retail, construction, and landscaping were most likely to get started with under $5,000, according to Embroker’s 2025 startup stats.

- Employee cost multiplier: SBA advises that an employee typically costs 1.25 to 1.4 times their salary.

- Commercial space cost: Expect to pay about $2.10 / ft² for utilities, plus retail rents around $24 / ft² and office avg $35 / ft².

- Marketing budget: Small businesses spend roughly 1–4% of revenue on advertising, with SBA noting startups often allocate more; retail sits near 4% and the overall average is ~1.08%.

The Money Challenge

- Main funding source: 52% of prospective small business owners turn to 401(k) business financing (Rollovers for Business Startups).

- Credit applications: 50% of small employer firms applied for a total of $100,000 or less, and 30% applied for $50,000 or less, according to Federal Reserve data.

- Revenue trends: Firms were more likely to report that revenues decreased rather than increased in the prior 12 months (Federal Reserve 2024 Small Business Credit Survey).

- Startup funding: Both nonemployer and employer startup firms were more likely than older firms to have received funds from their owners.

Budget Allocation Insights

- Product costs: Product costs, which include raw materials and inventory, take up the largest share of small business funds allocation at 31.6%.

- Operating costs: Operating costs, such as legal fees and accounting services, use up 11% of the budget.

- Online presence: Online store expenses account for 9%, while shipping costs, including packaging, make up additional operational expenses.

Business Motivations

- Top reasons to start: Be their own boss (60%), leave corporate jobs (47%), follow a passion (31%), according to Guidant Financial 2024.

- Employment growth: Employment growth held steady between the 2023 and 2024 surveys according to Federal Reserve data.

Note: These numbers aren’t meant to scare you. They’re meant to help you plan better. If you’re starting a service business with $5,000, you’re in good company. If you’re opening a restaurant with $200,000, that’s normal too.

The key here is matching your expectations to your industry’s reality and having proper cash flow management in place from day one.

Note: These data are compiled from multiple reputable U.S. government agencies, financial institutions, industry surveys, and business research organizations.

What Most Entrepreneurs Miss When Budgeting

Initial financial projections often underestimate real-world implementation costs. These two common mistakes can cost you big.

1. Unexpected Expenses Hit Hard

Many small businesses experience unexpected costs that weren’t part of their original budget. Price increases, shipping delays, equipment failures, and other unforeseen circumstances add up quickly and can derail even well-planned budgets.

2. Budgets Are Too Optimistic

Most founders underestimate real costs by 25-50%. That’s why the 10-20% contingency fund recommended by SCORE is crucial for financial stability.

3. Professional Help Costs More

Lawyers, accountants, and consultants typically cost $300-$1,500 depending on complexity. The SBA recommends budgeting for professional services as part of your one-time startup expenses.

4. Personal Living Expenses

You still need to eat and pay rent while building your business. Ignoring personal expenses is a fast track to burnout.

Why Financial Projections Are Critical for Your Business Success

Financial projections are detailed forecasts that estimate a business’s future revenue, expenses, and cash flow over a set time period. Typically, it ranges from 1 to 5 years.

This might sound like boring spreadsheet work, but they’re actually your business survival tool. Think of them as your GPS for navigating the first few years of business ownership.

Ultimately, they help business owners and investors understand how the company is expected to perform financially, plan for growth, and make informed decisions.

Cash Flow Forecasting

Know exactly when your money will run out so you can plan ahead and avoid surprises.

- Predict when you’ll run out of money: This isn’t a pessimistic thought. Knowing your “runway” helps you make crucial decisions before you’re desperate.

- Plan for seasonal fluctuations: If you’re selling swimwear, you’ll need cash to survive the winter months. If you’re a tax accountant, you’ll need to prepare for the summer slowdown.

- Identify funding needs in advance: It’s much easier to secure a loan when you don’t desperately need it. Projections help you spot future cash needs months ahead.

Investor and Lender Requirements

Good financial projections show investors and banks that you understand your business and market.

- Most investors require 3-5 year financial projections: They want to see that you understand your business model and market opportunity. Even if you’re not seeking investors now, having projections shows you’re serious.

- Banks love detailed projections: When applying for business loans, detailed financial forecasts demonstrate that you’ve thought through your business thoroughly.

- Shows market understanding: Your projections reveal whether you truly understand your industry’s profit margins, growth rates, and seasonal patterns.

Strategic Decision Making Made Easier

Use projections to plan smart, spend wisely, and grow at the right time.

- Pricing strategy: Projections help you determine if your pricing covers costs and generates profit. Can you really make money selling that product for $29?

- Hiring decisions: Should you hire that employee now or wait three months? Your projections will tell you if you can afford the additional salary.

- Expansion planning: Projections help you decide when to open that second location, launch that new product line, or invest in better equipment.

Risk Management and Scenario Planning

Market volatility and operational challenges require scenario-based planning. Projections help you stay ready for ups, downs, and everything in between.

Best case vs. worst case: What if sales are 50% higher than expected? What if they’re 30% lower? Having scenarios helps you prepare for both opportunities and challenges.

Appropriate financing: Should you take a $50,000 loan or a $20,000 loan? Projections help you borrow the right amount without over-leveraging.

Early warning system: Regular comparison between projections and actual results helps you spot problems early when they’re still fixable.

Bottom Line on Projections

You don’t need to be a financial expert to create useful projections. Start simple:

- Monthly sales estimates for the first year

- Fixed costs (rent, insurance, loan payments)

- Variable costs (inventory, materials, commissions)

- Personal salary requirements

Remember: Projections aren’t predictions. They’re planning tools. They’ll be wrong, and that’s okay. The value is in the thinking process and having a framework to measure your progress.

Real Entrepreneurs Share Their Startup Business Costs

Briefly see how real founders started with what they had, what they spent, and what worked. Use their lessons to plan your own smarter.

Urban EDC (USA) – $10,000 Investment, $1.3M Annual Revenue

Yong-Soo left his crypto job and invested $10,000 of his savings into Urban EDC, an online store. He handled everything himself. For example, the packing orders, social media, customer service, and he didn’t pay himself a salary initially.

Key Lesson: “Build a strong community of customers who genuinely care about your products. That organic growth helped more than any expensive advertising.”

Current Status: Over $1.3 million in annual revenue.

The Fable (Australia) – $7,000 Car Sale Startup

Sophie had zero fashion background but a vision for quality silk shirts. She sold her car for $7,000 AUD ($4,500 USD) and taught herself design online while finding suppliers.

Key Lesson: “Start with what you have and learn as you go. Growing slowly and focusing on product quality made all the difference.”

Current Status: Over $4.5 million in annual revenue.

TALA & SHREDDY (UK) – £80,000 Near-Disaster Success

Grace invested £80,000 from her previous business into TALA (sustainable clothing) and SHREDDY (fitness app). Things got tight. She nearly couldn’t make payroll and had to sell her car to cover costs.

Key Lesson: “Plan for everything going wrong because it probably will. Having backup plans saved my business.”

Current Status: The Company is valued at approximately £70 million.

KOGLAND (India) – $7,000 Niche Focus

This medical supply company started with $7,000, focusing specifically on helping healthcare workers get supplies quickly and efficiently.

Key Lesson: “Pick a clear niche and solve a real problem. It wasn’t glamorous, but it worked.”

Current Status: Over $360,000 in annual revenue and growing.

What We Suggest

What sets successful entrepreneurs apart isn’t having unlimited money. In most cases having clarity about their numbers and the discipline to stick to their plan.

- Start with your numbers, not your dreams: Use the 3-step framework to calculate your real costs, add that 15-20% buffer, and build your projections from there.

- Learn from those who’ve walked the path: Yong-Soo’s $10,000 investment became $1.3 million in revenue. Sophie sold her car for $7,000 and built a $4.5 million business. Grace nearly went broke but created a £70 million company. Their secret? They started with what they had and adapted as they learned.

- Use the right tools to work smarter: Always go for fast, secure, and easily scalable tools. For everything like selling stuff online, keeping track of customers, and helping people when they need it.

- Make the most of what’s out there: Smart business owners don’t try to do everything alone. Some look into funding like SBA loans or Startup India programs. Others find support through mentors or local business groups. The right mix of help can make things move faster and feel less overwhelming.

Wrapping Up

The difference between those who succeed and those who struggle isn’t the size of their initial investment. It’s the quality of their planning and their willingness to adapt.

Your journey from idea to profitable business starts with understanding your true costs. You now have the tools, examples, and framework to make that calculation with confidence.

Remember, the goal isn’t to have the perfect plan. It’s to have a realistic plan that gives you the best chance of success while protecting your financial future.

The entrepreneurs who shared their stories in this guide didn’t have special advantages. They had clarity about their costs, persistence through challenges, and the wisdom to start before they felt completely ready.

Your business is waiting. Your numbers are ready. What’s your next move?

Frequently Asked Questions

Useful things to know from our helpful customer support team

Deputy Marketing Lead, published literary author, and musician. I thrive on marketing for tech companies while composing music, collecting books of lasting depth, exploring cinema with a discerning eye, and studying the arts and history.

Subscribe now

Leave a Reply