eCommerce Accounting 101: How to Track Finances in 2026

I’ve worked with enough eCommerce brands to spot a pattern pretty quickly. The ones that struggle usually aren’t bad at selling. They’re bad at knowing what their sales actually mean.

Revenue looks good. Orders are flowing. Ads are running. But when you ask a simple question, “How much profit did you make last month?” the answer gets fuzzy.

That’s not a marketing problem. That’s an accounting problem.

eCommerce accounting isn’t glamorous, but it’s the difference between running a real business and guessing your way through one. And the sooner you treat it seriously, the easier everything else becomes.

TL;DR

- Most ecommerce businesses don’t fail at selling—they fail at understanding profit

- Ecommerce accounting tracks everything, not just sales and expenses

- Inventory, fees, refunds, timing gaps, and taxes make ecommerce accounting more complex than traditional accounting

- Clean accounting replaces guesswork with real financial clarity

- Accrual accounting gives the most accurate picture as you grow

- Good tools should automate syncing, inventory, taxes, and reporting

- FluentCart helps by capturing clean sales data and providing clear analytics before it reaches your accounting system

- Bookkeeping records activity; accounting turns it into strategy

- Strong accounting turns growth into sustainable, stress-free wealth

What is eCommerce Accounting

eCommerce accounting is the system you use to record, organize, and understand every financial movement in your online business.

Not just sales.

Not just expenses.

Everything in between.

That includes:

- Sales that haven’t been paid out yet

- Platform and payment fees

- Refunds and chargebacks

- Inventory purchases sitting in storage

- Shipping costs you paid weeks before the sale

- Taxes you owe but haven’t paid yet

Without a proper accounting system, your business can look healthy while quietly bleeding cash. Good eCommerce accounting helps you:

- Know whether promotions actually make money

- Understand true profit, not just revenue

- Plan inventory without choking cash flow

- Prepare for taxes without last-minute panic

- Make confident decisions instead of emotional ones

It replaces gut feeling with clarity.

Why eCommerce Accounting vs Traditional Accounting

eCommerce businesses don’t follow the clean, linear money flow of traditional businesses. The rules are messier.

Multiple Channels, One Set of Books

You might sell through your own store, marketplaces, social platforms, and email campaigns. Each one reports sales differently, pays out on different schedules, and takes different fees. Accounting is about pulling all of that into one accurate financial story.

Inventory Is Frozen Cash

Inventory isn’t an expense when you buy it. It’s money tied up in products that might sell later. If you don’t track inventory properly, your profit numbers are basically fiction.

Timing Is Always Off

You ship today.

You get paid later.

Fees come out immediately.

Taxes show up months later.

Accounting exists to make sense of that timing gap.

Refunds Are Normal

Returns aren’t mistakes; they’re part of eCommerce. Your accounting system has to handle them cleanly without wrecking your numbers.

Security Isn’t Optional Anymore

Your accounting data is some of the most sensitive information in your business. Treat it that way.

At minimum:

- Use two-factor authentication

- Restrict access to only essential team members

- Separate financial tools from marketing and CRM tools

- Ensure regular backups exist

- Keep everything updated

A data breach doesn’t just cost money. It destroys trust.

The Two Accounting Methods You Need to Understand

You don’t need to be an accountant, but you do need to understand this distinction.

Cash-Based Accounting

You record money when it enters or leaves your bank account.

Simple. Intuitive. Common for very small businesses.

The downside?

It can hide problems. You might feel profitable while future bills and inventory costs pile up quietly.

Accrual Accounting

You record revenue when the sale happens and expenses when they’re incurred—even if the money hasn’t moved yet.

This method:

- Shows true profitability

- Matches income with related costs

- Makes inventory tracking accurate

- Scales with growth

If you’re serious about building a sustainable eCommerce business, accrual accounting gives you the clearest picture of reality.

What to Look for in eCommerce Accounting Tools

Instead of focusing on names, focus on capabilities.

Your accounting setup should sync automatically with your eCommerce store. It must track inventory and the cost of goods accurately. An eCommerce accounting tool handles refunds, fees, and partial payments cleanly.

One more important task of the tool is supporting sales tax tracking. It offers reports you can actually use and scale as order volume increases.

If your system requires constant manual cleanup, it’s not helping, but it’s slowing you down.

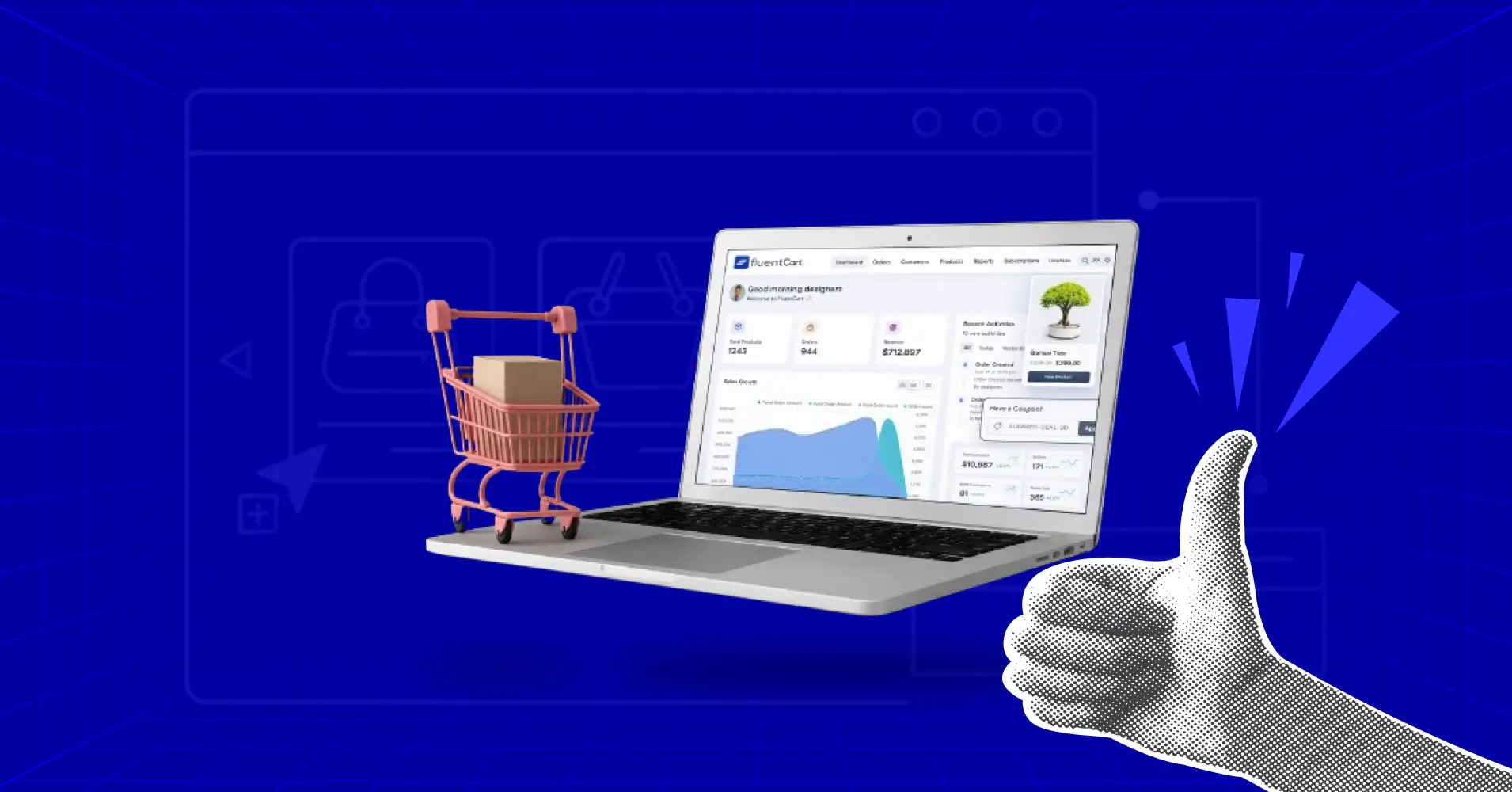

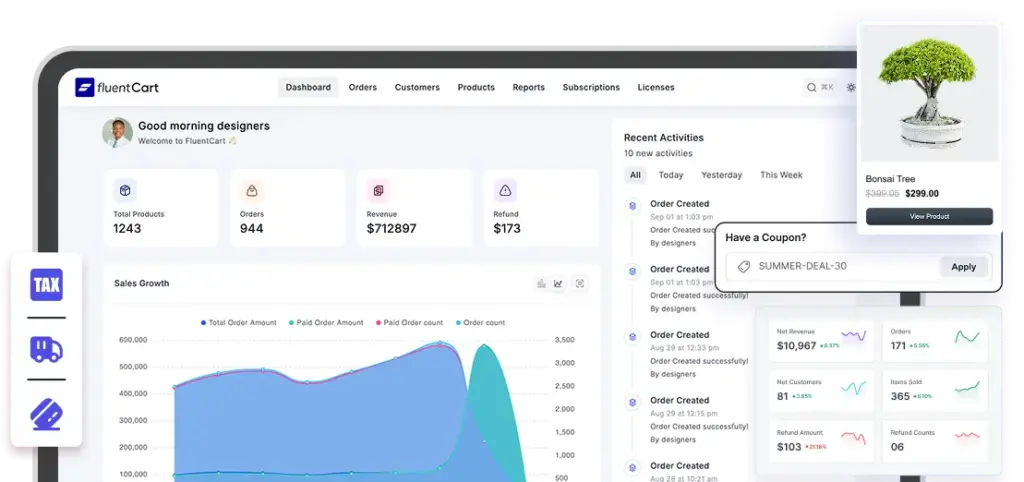

Where FluentCart Fits In

For eCommerce stores built on WordPress, FluentCart plays an important supporting role. It’s not accounting software on its own, but it fills a major gap.

FluentCart helps by:

- Capturing clean order data at the source

- Providing robust analytics and reporting dashboards

- Giving clear visibility into sales, refunds, and customer behavior

- Reducing data discrepancies before they reach your accounting system

When your sales data is clean and structured from the beginning, accounting becomes easier, more accurate, and far less stressful. FluentCart helps create that foundation for eCommerce stores that want clarity without complexity.

Bookkeeping vs Accounting

Bookkeeping is recording what happened.

Accounting is understanding what it means.

They’re not the same thing.

Most eCommerce founders can handle basic bookkeeping early on. But as inventory grows, taxes get complicated, or cash flow tightens, accounting becomes strategic—not optional.

A good accountant doesn’t just file reports. They help you:

- Spot profit leaks

- Optimize taxes

- Price products correctly

- Plan growth safely

The Bottom Line

eCommerce accounting won’t excite you. It won’t go viral. It won’t boost your conversion rate overnight.

But it will:

- Keep your business grounded in reality

- Prevent expensive surprises

- Turn growth into actual wealth

You don’t need a perfect system on day one. You need a consistent, honest one.

Start simple. Track everything. Use tools that fit eCommerce, not generic setups. Make sure your sales data is clean. And when things get complex, don’t try to power through blindly.

- Great marketing builds momentum.

- Great accounting keeps you standing.

Get your numbers right, and everything else gets easier.

WordPress, automation, eCommerce and growth marketing specialist, a Core Contributor and Media Corps member blending storytelling with technology to craft purposeful strategies in SEO, email marketing, and beyond.

Subscribe now

Leave a Reply