FluentCart Shipping & Tax

Keep checkout fast, totals transparent, and compliance automatic.

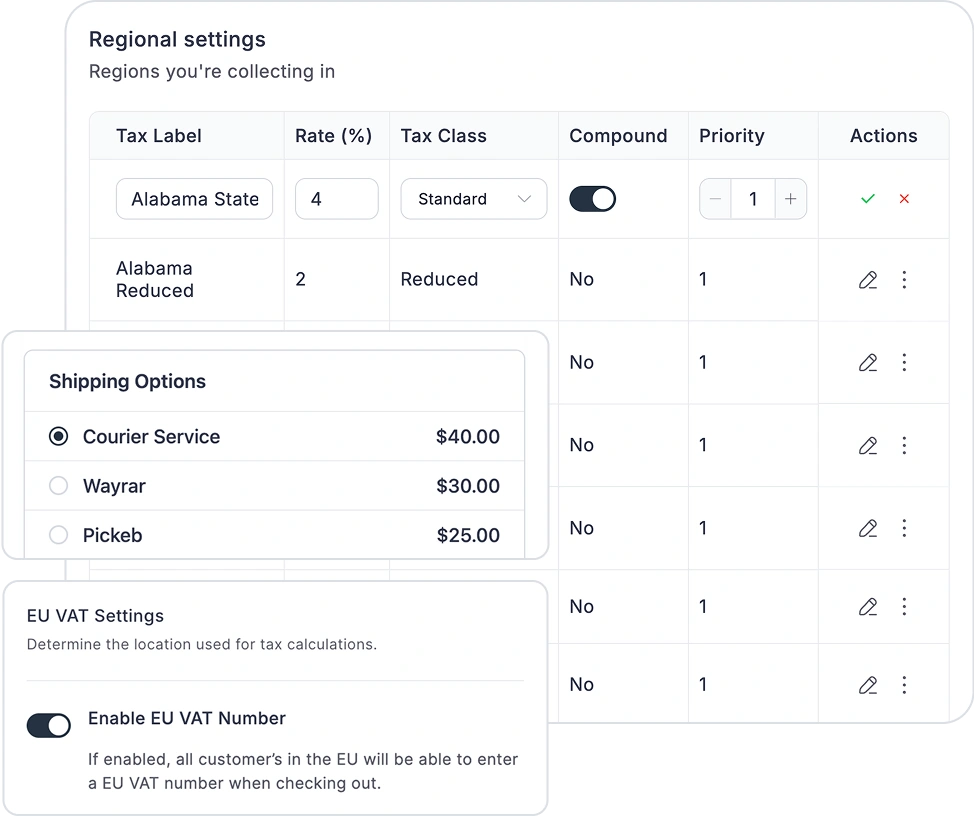

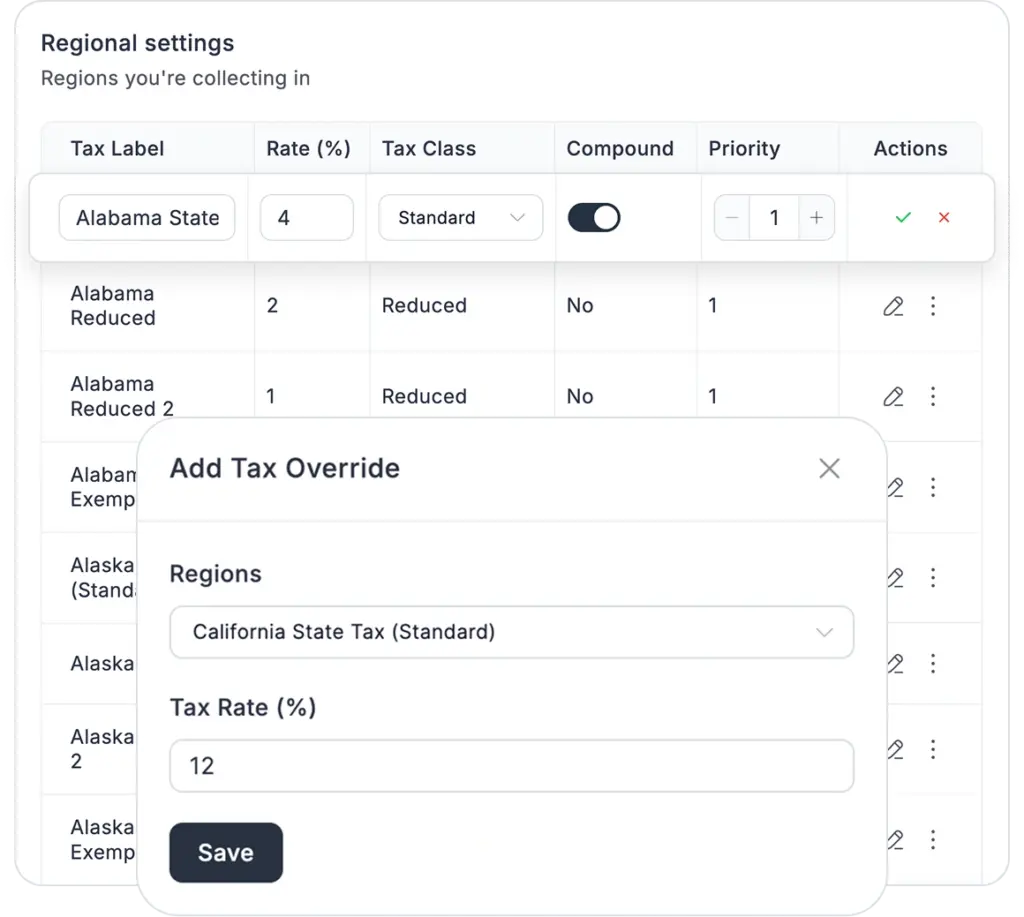

Tax & Compliance Management

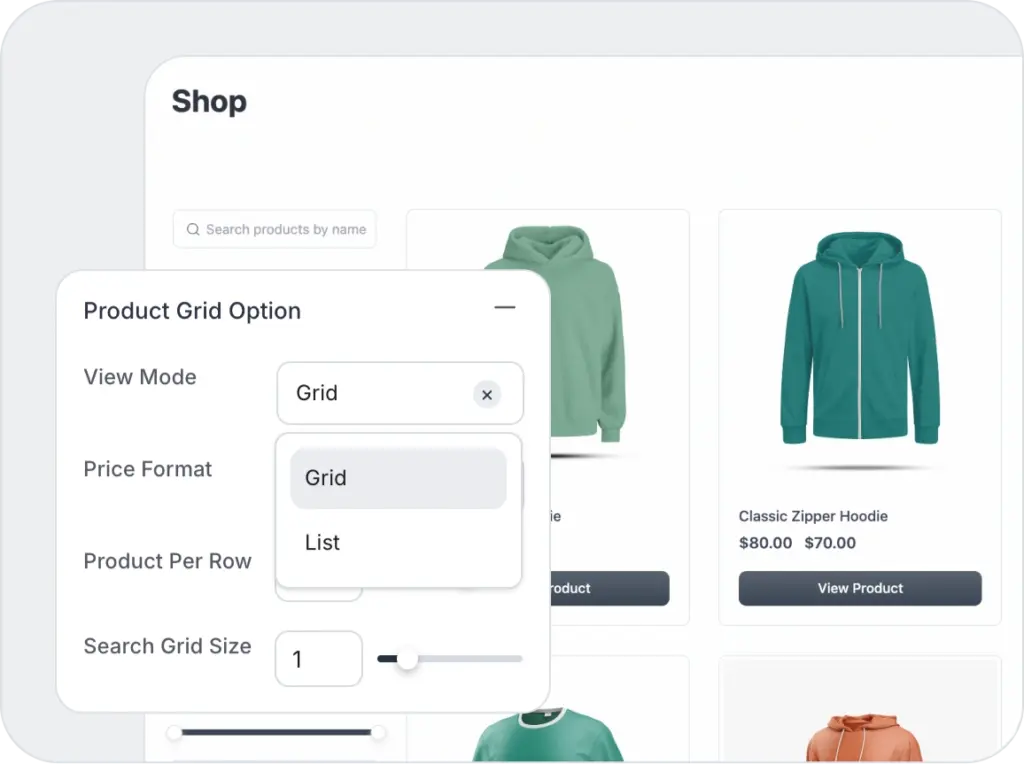

Simplify the buying process and improve the shopping experience with FluentCart.

Flexible Shipping with Rules

Simplify the buying process and improve the shopping experience with FluentCart.

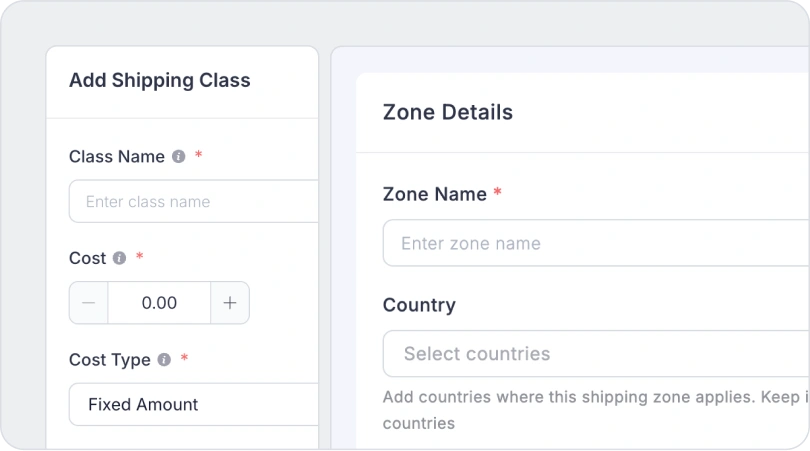

Flexible Shipping Rules

Set shipping rates by zone, product type, weight, or cart value with control.

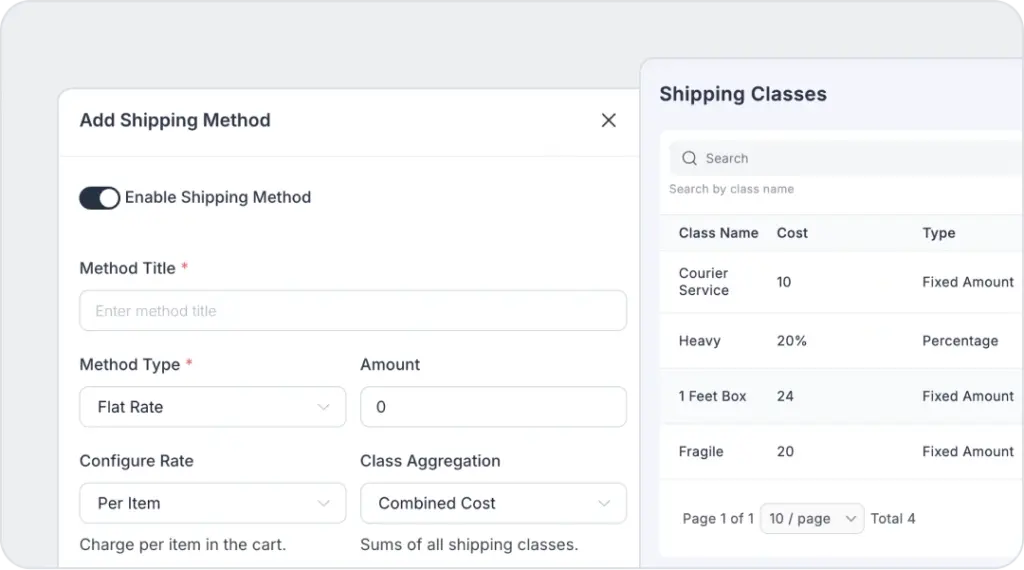

Shipping Methods & Classes

Create flat, free, or local pickup options and assign shipping classes easily.

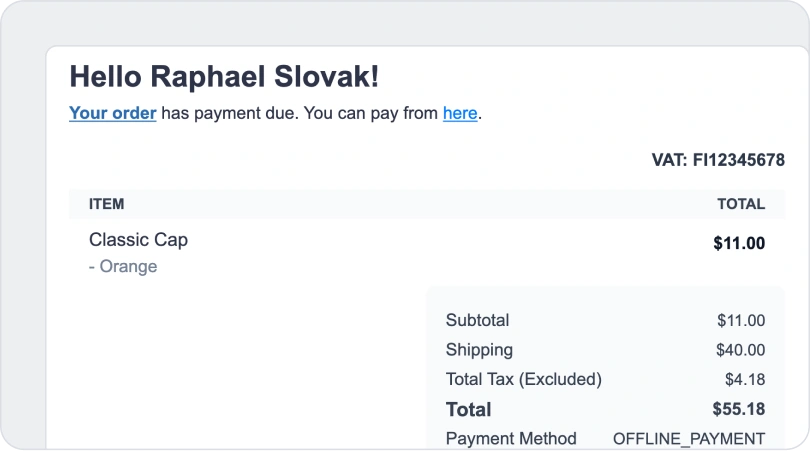

Shipping Invoices & Tax

Show shipping costs, tax breakdowns, and VAT numbers clearly on receipts.

Advanced Shipping Calculations

Combine multiple shipping classes and methods for precise order cost totals.

High-Performance Checkout

Fast, accurate checkout with smart shipping, fees, and automated tax reporting.

Checkout Fields

Show only essential fields while keeping optional ones easy for faster purchases.

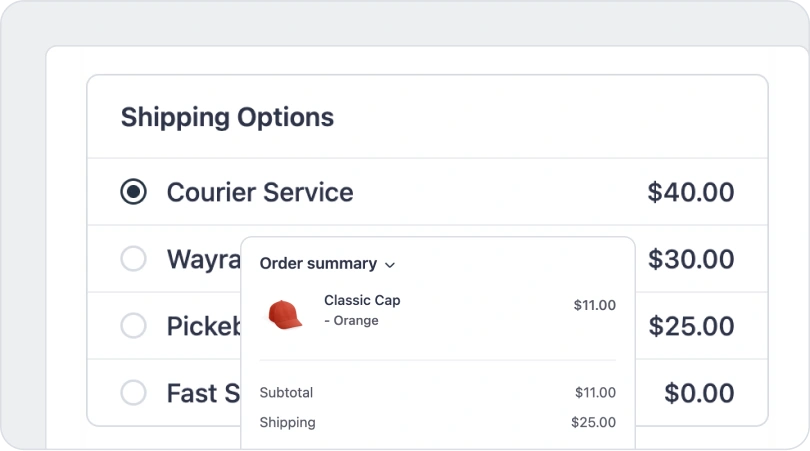

Order Summary

Display taxes, shipping, and totals clearly before payment to build trust.

Smart Shipping Options

Offer relevant shipping choices dynamically based on customer location and cart contents.

Fee Calculations

Automatically adjust shipping costs and extra fees for weight, class, or product type.

Tax Compliance

Apply local, EU, or cross-border tax rules seamlessly during checkout for accuracy.

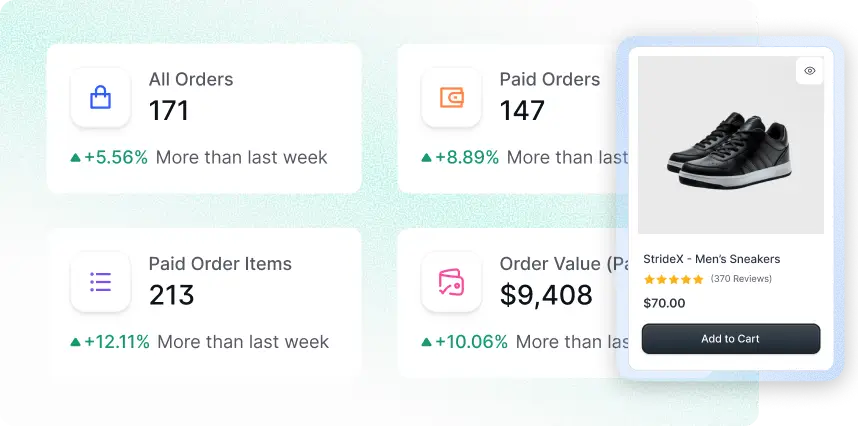

Real-Time Reporting

Generate immediate, accurate VAT and shipping reports linked to completed orders.

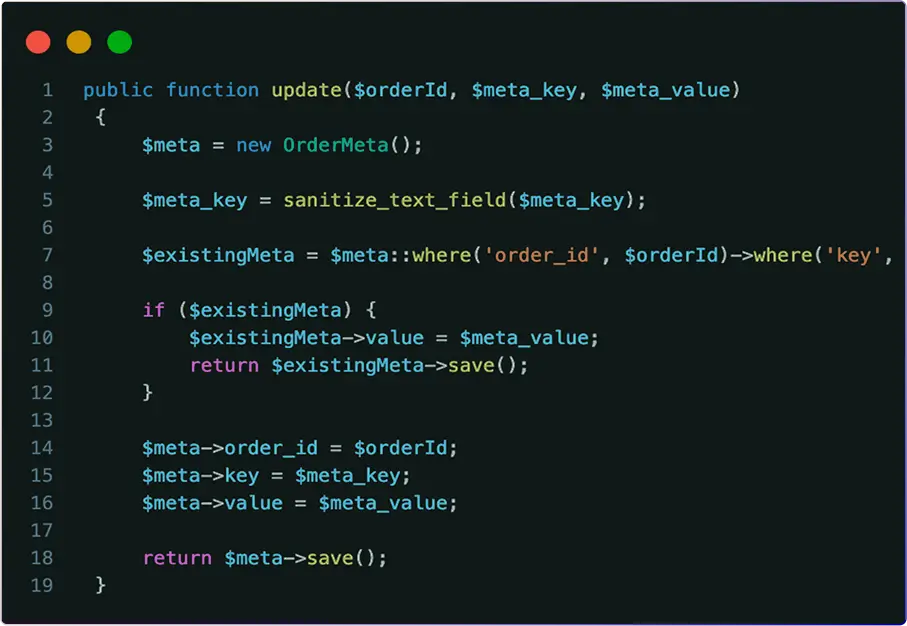

For Developers? Even Better

Need custom builds or integrations? FluentCart is flexible enough for any tech stack.

What You Get from Day One

Unlock Exclusive Lifetime Deal

Enjoy a faster, more intuitive eCommerce experience for WordPress built to perform.

1 Site License

$199

5 Sites License

$499

15 Sites License

$699

50 Sites License

$899

(Annual Payment)

50 Sites License

Build client sites with confidence with the Agency Lifetime Tier.

Pay 12 monthly installments and avail FluentCart for Life. 0% transaction fee.

$99/mo

(For 12 Months)

$1099

(One Time Payment)

Features Included on all FluentCart Plans

Frequently Asked Questions

Useful things to know from our helpful customer support team.