What Is Last In First Out (LIFO)? How It Affects Your Business

Running a business means making countless decisions that affect your bottom line. One choice that might seem technical but can save you thousands in taxes is how you account for your inventory. That’s where LIFO comes in.

Understanding it could be the difference between paying more to the IRS than necessary or keeping that cash in your business where it belongs.

TL;DR

- LIFO (Last-In, First-Out) is an accounting method that impacts profits, taxes, and financial reporting.

- Real-world examples with numbers show how LIFO works in practice.

- Tax advantages can lower your yearly liability and improve cash flow.

- LIFO vs. FIFO: know when to apply the right method for your business.

- Step-by-step implementation guide makes setup easier for accounting teams.

- Common mistakes to avoid help ensure compliance and accurate reporting.

- Done right, LIFO improves accounting accuracy, saves money, and strengthens business finances.

What is LIFO?

Definition

LIFO (Last In, First Out) is an inventory accounting method where the most recent purchases are treated as sold first. It applies this rule regardless of which physical items actually leave your warehouse.

This approach treats your newest, typically more expensive inventory as your cost of goods sold, while older inventory stays on your books at historical prices.

Unlike physical inventory management, LIFO is purely a financial calculation that can significantly reduce your tax burden during inflationary periods. When prices rise, using your higher recent costs against current sales revenue results in lower taxable profits – meaning more money stays in your business instead of going to taxes.

Think of LIFO like a stack of plates in your kitchen. The last plate you put on top is the first one you take when you need it. But here’s the crucial difference: in business, you’re not actually required to sell your physical “top plate” inventory first. You’re simply accounting for sales as if you did.

This method is exclusively available to U.S. businesses under Generally Accepted Accounting Principles (GAAP), while International Financial Reporting Standards (IFRS) prohibit its use worldwide. The reason? LIFO can substantially reduce government tax revenue during periods of inflation. This makes it attractive to businesses but less appealing to tax authorities.

Why This Matters More Than You Think

Let’s say you run an electronics store. In January, you bought 100 phones for $300 each. By June, the same phones cost $350 each due to supply chain issues, so you bought another 100 at this higher price.

When you sell a phone in July, LIFO assumes you’re selling one from your June inventory (the $350 phone), not from January ($300). This higher cost of goods sold means lower profits on paper, and lower profits mean lower taxes.

That’s the magic of LIFO. During periods when prices rise (which happens more often than not), this method legally reduces your tax burden.

How LIFO Accounting Works with Real Examples

Let me show you exactly how this plays out with concrete examples.

LIFO Formula

COGS (LIFO) = Cost of Most Recent Purchases × Units Sold

Where, COGS = Cost of Goods Sold

You assign the most recent inventory costs to sales first. The ending inventory is valued using the oldest costs still remaining.

FIFO Formula

Definition

FIFO (First In, First Out) is an inventory accounting method where the earliest purchases are recorded as sold first. It applies this rule regardless of which physical items actually leave your warehouse.

Let’s see the formula,

COGS (FIFO) = Cost of Oldest Purchases×Units Sold

Where, COGS = Cost of Goods Sold

Under FIFO, sales are matched with the earliest inventory costs first. The ending inventory is valued using the most recent costs.

First Example

Sarah owns a specialty coffee shop. Here’s her bean inventory for the last quarter:

- January: Purchased 200 pounds at $8/pound = $1,600

- February: Purchased 200 pounds at $9/pound = $1,800

- March: Purchased 200 pounds at $10/pound = $2,000

In April, Sarah sells 300 pounds of coffee beans to a local restaurant for $15/pound, generating $4,500 in revenue.

Using LIFO

- Cost of goods sold: (200 × $10) + (100 × $9) = $2,900

- Gross profit: $4,500 – $2,900 = $1,600

Using FIFO (for comparison)

- Cost of goods sold: (200 × $8) + (100 × $9) = $2,500

- Gross profit: $4,500 – $2,500 = $2,000

The difference? LIFO resulted in $400 less taxable income. Depending on Sarah’s tax bracket, this could save her $100-150 in taxes on this single transaction.

Second Example

Mike’s auto parts business bought brake pads throughout 2024:

- Q1: 1,000 units at $25 each = $25,000

- Q2: 1,000 units at $28 each = $28,000

- Q3: 1,000 units at $32 each = $32,000

When Mike sells 2,000 brake pads at $50 each ($100,000 revenue):

LIFO calculation

- COGS: (1,000 × $32) + (1,000 × $28) = $60,000

- Gross profit: $100,000 – $60,000 = $40,000

FIFO calculation

- COGS: (1,000 × $25) + (1,000 × $28) = $53,000

- Gross profit: $100,000 – $53,000 = $47,000

Mike’s LIFO choice reduced his taxable income by $7,000. At a 25% tax rate, that’s $1,750 in tax savings.

When LIFO Makes Perfect Sense (And When It Doesn’t)

Knowing when to apply the Last In First Out method helps you maximize tax benefits and avoid costly mistakes.

LIFO Works Best When

1. Inflation Affects Your Industry If your product costs keep rising, LIFO becomes your friend. Industries like automotive, electronics, and construction materials often see steady price increases.

2. You Maintain Large Inventories The more inventory you carry, the bigger the potential tax savings. Retailers, wholesalers, and manufacturers typically benefit most.

3. Cash Flow Matters More Than Reported Profits If you’d rather keep money in your business than show higher profits to investors, LIFO helps by legally reducing your tax liability.

Skip LIFO If

1. Your Costs Are Falling In deflationary periods, LIFO actually increases your taxes. Tech companies dealing with rapidly decreasing component costs might avoid LIFO.

2. You’re Seeking Investment Lower reported profits might make your business less attractive to investors or lenders who focus on income statements.

3. Your Inventory Doesn’t Fluctuate Much If your costs remain relatively stable, the complexity of LIFO might not be worth the minimal benefits.

The Hidden Benefits of LIFO

1. Cash Flow Improvement

Beyond tax savings, LIFO can significantly improve your cash flow. Here’s how:

When you use LIFO during inflationary periods, you’re essentially matching today’s sales with today’s costs. This gives you a more realistic picture of your actual profitability and helps you price products appropriately.

2. Competitive Pricing Advantage

Companies using LIFO often have a better understanding of their true current costs. This insight helps them:

- Price products more competitively

- Negotiate better with suppliers

- Make informed purchasing decisions

3. Financial Planning Precision

LIFO forces you to think about inventory costs more strategically. You become more aware of price trends in your industry, leading to better forecasting and planning.

Getting Started with LIFO

A clear strategy ensures LIFO is implemented smoothly, compliant with regulations, and optimized for tax savings.

Step 1: Evaluate Your Business

Before switching to LIFO, honestly assess whether it fits your situation:

- Are your inventory costs generally increasing?

- Do you maintain substantial inventory levels?

- Is tax minimization a priority over reported earnings?

Step 2: Consult Your Accountant

Adopting LIFO is a formal tax election. Once you make this choice, it applies to both tax reporting and financial statements, and the commitment carries long-term implications.

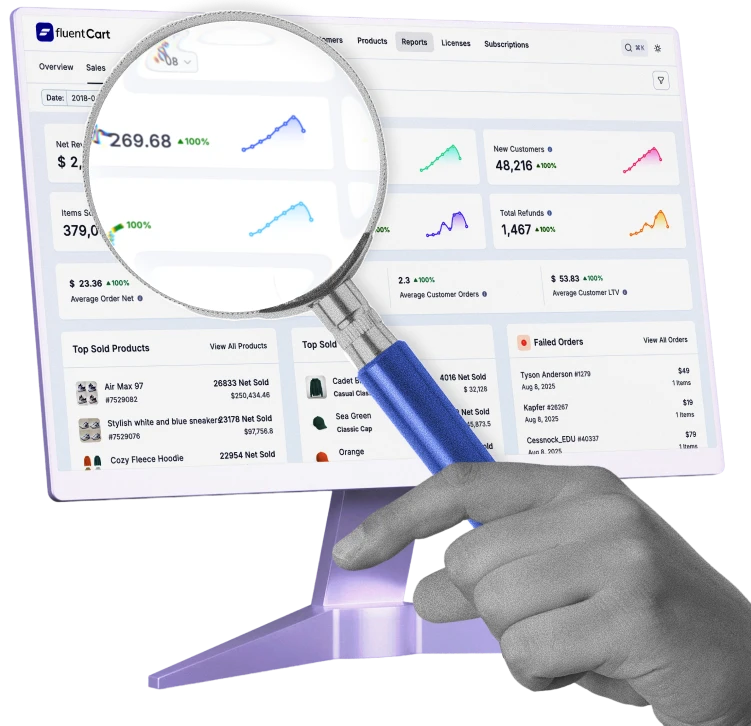

Step 3: Implement Proper Tracking Systems

You’ll need robust inventory management to track different cost layers. Consider these requirements:

- Software capabilities: Ensure your system can handle LIFO calculations

- Documentation: Maintain detailed purchase records with dates and costs

- Regular monitoring: Track cost trends to maximize LIFO benefits

Step 4: Time Your Purchases Strategically

Understanding LIFO lets you optimize your purchasing timing. If costs are rising and year-end approaches, purchasing inventory in December (rather than January) can increase your current year’s tax deduction.

Common LIFO Mistakes That Cost Money

Avoiding common LIFO mistakes protects your tax savings and keeps your accounting compliant.

Mistake 1: Liquidating LIFO Layers

If you sell more inventory than you purchased in a year, you “dip into” older, cheaper inventory layers. This creates a sudden profit spike and tax hit. Planning inventory levels helps avoid this trap.

Mistake 2: Poor Documentation

The IRS requires detailed records for LIFO elections. Missing or inadequate documentation can disqualify your LIFO benefits entirely.

Mistake 3: Inconsistent Application

You can’t cherry-pick when to use LIFO. Once elected, you must apply it consistently unless you formally change methods (which requires IRS approval).

LIFO vs FIFO: Which Inventory Method Fits Your Business

Comparing LIFO and FIFO helps you choose the right method for tax savings, reporting accuracy, and global compliance.

| Factor | LIFO | FIFO |

| Tax Impact (Inflation) | Lower taxes, higher cash flow | Higher taxes, lower cash flow |

| Inventory Valuation | Understates ending inventory | Reflects current market value |

| Profit Reporting | Lower reported profits | Higher reported profits |

| International Use | US only | Accepted globally |

| Complexity | More complex tracking | Simpler implementation |

Special Considerations for Different Industries

The impact of LIFO varies by industry, since inventory size, cost trends, and sales patterns differ. Understanding these nuances ensures you apply the method where it delivers the most value.

1. Retail and eCcommerce

Online retailers often benefit from LIFO because:

- Inventory turns quickly

- Shipping and storage costs keep rising

- Competition requires tight margin management

2. Manufacturing

Manufacturers using LIFO should consider:

- Raw material price volatility

- Work-in-process inventory complications

- Finished goods cost allocation

3. Automotive

Auto dealers particularly benefit because:

- Vehicle costs generally increase annually

- Large inventory investments

- Seasonal sales patterns

The Tax Law Reality Check

Here’s something critical: if you use LIFO for tax purposes, you must also use it for financial reporting. This “LIFO conformity requirement” means your financial statements will show lower profits.

For public companies, this creates a dilemma between tax savings and investor perception. Private companies often find this trade-off worthwhile.

Advanced LIFO Strategies

Beyond the basics, advanced LIFO methods help businesses handle complex inventories, adapt to product changes, and maximize long-term tax advantages.

1. Dollar-Value LIFO

Instead of tracking specific units, dollar-value LIFO groups similar inventory and adjusts for inflation. This method works well for businesses with diverse product lines.

2. Link-Chain Method

This approach helps businesses with changing product mixes maintain LIFO benefits even when specific products are discontinued.

3. LIFO Reserve Management

Sophisticated businesses track their “LIFO reserve”, the difference between FIFO and LIFO inventory values. This metric helps evaluate the cumulative tax benefits of using LIFO.

Make Your Decision

Ask yourself these questions

- Are my inventory costs trending upward? If yes, LIFO likely benefits you.

- Do I maintain significant inventory levels? Larger inventories mean bigger potential savings.

- Is immediate cash flow more important than reported profits? LIFO improves cash flow through tax savings.

- Can I handle the additional accounting complexity? LIFO requires more sophisticated tracking.

- Do I plan to go public or seek investment? Lower reported earnings might affect these goals.

The Bottom Line

LIFO is a strategic business decision that can save thousands in taxes annually. For businesses with rising inventory costs and substantial stock levels, the benefits often far outweigh the additional complexity.

However, success with LIFO requires proper implementation, consistent application, and strategic thinking about inventory management. It’s not a “set it and forget it” decision.

So, before making the switch, model the potential impact on your specific situation. Calculate the tax savings, consider the reporting implications, and ensure you have systems in place to manage the additional requirements.

Note that the best inventory accounting method is the one that aligns with your business objectives, whether that’s minimizing taxes, maximizing reported earnings, or simplifying operations.

The choice is yours, but now you have the knowledge to make it wisely.

Frequently Asked Questions

Deputy Marketing Lead, published literary author, and musician. I thrive on marketing for tech companies while composing music, collecting books of lasting depth, exploring cinema with a discerning eye, and studying the arts and history.

Subscribe now

Leave a Reply