Margin vs Markup: Pricing Formula That Decides Your Profit

Have you ever checked how you are calculating your profit? If the answer is NO the I have bad news for you. You’re losing money on your business. And you won’t realize it until it’s too late. We’re going to talk about profit margin vs markup. You might think these are the same thing. Well then, keep reading, mate.

TL;DR

Margin vs Markup: Margin = profit ÷ revenue, Markup = profit ÷ cost. Same profit, different percentages.

Markup = Operational Tool: Great for day-to-day pricing, especially with tangible goods or services. Easy, predictable, and ensures coverage of costs.

Margin = Strategic Compass: Focuses on revenue, value to customer, and true profitability. Helps make smarter business decisions.

Exponential Reality: Small cost changes can drastically affect margins, less obvious with markup-only thinking.

Smart Combo: Use markup for pricing, margin for strategy. But if you pick one to master, margin wins for long-term business health.

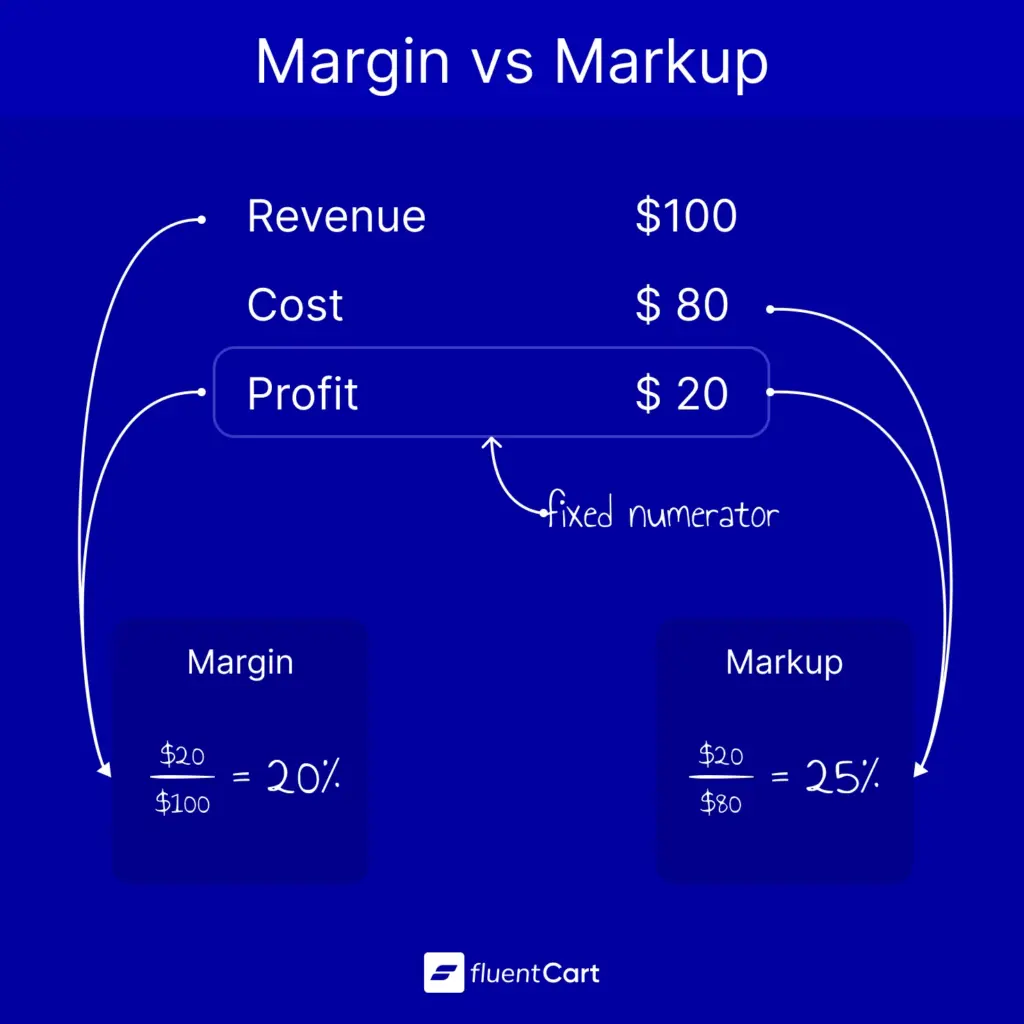

The math of margin vs markup

Margin vs markup are often confused, and commonly thought to be the same thing. But these two have totally different formulas to calculate. And this is one of the vital factors of how to price a product. If you are not a math nerd, no worries. Let’s keep this simple. We’ll use round numbers so your brain doesn’t hurt. Say you’re selling something for $100. It costs you $80 to make or buy it. You pocket $20 in profit.

Easy so far, right? Now here’s where people mess up.

Profit margin: revenue-first thinking

Let’s do the math for the margin. Margin takes your $20 profit and divides it by your $100 revenue.

$20 ÷ $100 = 20% margin

You’re looking at what percentage of your sales price is actual profit. This tells you: “For every dollar I bring in, how much do I keep?”

Markup: cost-first thinking

As I said, the math is totally different. Markup takes your $20 profit and divides it by your $80 cost.

$20 ÷ $80 = 25% markup

You’re looking at how much you’re adding on top of what you paid. This tells you: “I spent this much, now I’m adding this percentage on top.” Same $20 profit. Two totally different percentages.

Now, margin vs markup is not a war. It’s not that one is good and one is bad. Which one you choose depends on your business model. Let’s try to understand this.

Margin and markup calculator

Find out your business margin and markup using this simple calculator

When markup actually makes perfect sense

For a lot of businesses, markup is actually the smarter way to price. Here’s why.

Businesses that do better on markup

If you’re dealing with tangible goods, markup is highly useful. Retailers, wholesalers, manufacturers, they all think markup first. Service businesses, too. Plumbers, cleaning companies, security firms. They know their labor and material costs, apply their markup, and simply they have a price.

Markup works because

You guarantee profitability on every sale. When you start with cost and add your markup, you know you’re covering everything: materials, labor, overhead, the works. There’s no guessing.

It’s dead simple. Have you got 500 SKUs in your store? Just apply your standard markup across the board. And you have got your price.

Your financial planning becomes predictable. Consistent markups mean consistent, solid revenue prediction. You can budget accurately for business expenses. Because you know what’s coming in.

You build in a safety cushion. Materials go up? Supplier delays? Your markup absorbs those hits. It’s risk management built into your pricing. You need that in some business. The market can be very unpredictable.

You get a competitive baseline. Start with your markup, then adjust based on what the market will bear. You’re still profitable, but you’re flexible.

Pros of the cost-first approach

If you’re in a business where costs bounce around a lot, starting with cost is actually smarter. And here in the margin vs markup, the markup approach shines. You buy inventory at different prices throughout the year. Your labor costs shift. Material prices fluctuate.

Markup lets you maintain consistent profit relationships across all that chaos. You just multiply your cost by your markup factor, and you’re done. It’s operational efficiency at its finest.

Margin-based calculation

Now here’s where margin thinking changes the game. Margin doesn’t start with your spreadsheet. It starts with your customer’s willingness to pay. When you think in margins, you ask different questions:

- What’s this worth to the customer?

- What problem am I solving?

- What should the market price be?

- Can I deliver this profitably?

You’re technically working backwards from value to cost, not forwards from cost to price like markup. This matters more than you think.

Pros of the value-first approach

Margin forces you to think about your revenue as the starting point. Not as something you hope to achieve after adding markup. And that’s the major difference between margin vs markup. When you know your target margin, you can make smarter decisions:

- Should I take this contract?

- Can I afford this supplier?

- Is this customer segment profitable?

You’re managing your business based on how much of every dollar you keep, not just how much you’re adding to cost.

Margin vs markup

Here’s something wild that every business owner should see. Watch what happens when margins increase vs markups.

At 20% margin: Your markup is 25%

Profit: $20, Revenue: $100, Cost: $80

At 40% margin: Your markup jumps to 67%

Profit: $40, Revenue: $100, Cost: $60

At 60% margin: Your markup is now 150%

Profit: $60, Revenue: $100, Cost: $40

At 80% margin: Your markup explodes to 400%

Profit: $80, Revenue: $100, Cost: $20

See the pattern? Margins move almost linearly, but markups grow exponentially. This means if you’re only thinking markup, you might not realize how much your margin is actually changing when costs shift. A small cost increase can tank your margin without you noticing.

The safer bet

Both approaches have their place. But here’s why we lean toward margin thinking.

Margin keeps you honest about profitability. You always know what percentage of revenue you’re actually keeping. No surprises.

It protects you when costs increase. If your costs go up but you’re stuck at your markup percentage, your margin shrinks fast. But if you manage to reach your target margin, you’ll catch the problem immediately.

It aligns you with value, not just cost recovery. Margin thinking forces you to justify your pricing based on customer value, not just “cost plus X%.”

It scales better as you grow. When you’re making strategic decisions about which products or services to focus on, margin gives you a clearer picture of true profitability.

It’s how investors and analysts think. If you ever want funding or to sell your business, everyone’s going to ask about your margins, not your markups. You might notice that in Shark Tank, sharks asks for this number.

How to use both

Here’s the deal of margin vs markup; markup is great for operational pricing. It keeps things simple when you’re in the trenches, pricing products day to day. But margin should be your strategic compass. It tells you where your business actually stands.

You don’t have to pick one and ignore the other. Here’s how to use both effectively:

Use markup for day-to-day pricing. When you’re buying inventory, hiring for jobs, or pricing routine services, apply your standard markup. It’s fast, and it works.

Use margin for strategic decisions. When you’re evaluating overall business health, deciding which trendy products to push, or planning for growth, look at your margins.

Know how they relate in your business. Run the numbers for your typical profit levels. Understand what a 30% markup means in margin terms for your cost structure.

Monitor margin, manage markup. Your margin percentage tells you if you’re healthy. Your markup percentage tells you how to price.

The bottom line

Margin vs markup isn’t about right and wrong. It’s about knowing which lens to use and when. Use markup when you need operational simplicity, and cost-based pricing makes sense for your industry. Use margin when you need strategic clarity and want to manage profitability as a percentage of revenue.

But if you had to pick one to master between margin vs markup? Go with margin. Because at the end of the day, what matters isn’t how much you marked up your costs. It’s how much profit you kept from every dollar that came in the door. That’s the number that determines whether you’re building a business or just staying busy.

Leave a Reply