How to Price a Product: Strategies, Examples & Mistakes(+ Pricing Calculators)

Getting your pricing wrong can sink your business before it even takes off. Sounds dramatic, but it’s true. Research shows that even a tiny 1% improvement in pricing can boost your profits by around 11%.

Pricing isn’t just about numbers. It’s part science grounded in data, margins, and formulas, and part art shaped by perception, psychology, and positioning.

Yet most entrepreneurs will spend weeks perfecting their product, and then rush through pricing in a single afternoon.

This article is to fix that. Let’s break down what you need to know about pricing and how to price a product. From the simple math behind your costs to the smart, psychological strategies. You’ll get practical frameworks, examples, and step-by-step calculations.

What is Product Pricing

Product pricing is the process of determining the monetary value you’ll charge customers for your product or service. It’s where cost analysis meets market strategy, where your business goals intersect with customer expectations.

Think of pricing as a three-way negotiation between what it costs you to deliver, what customers are willing to pay, and what the market will bear.

Why Product Pricing Matters

Your price touches every part of your business. Set it too low, and you’ll make sales but lose money. Set it too high, and customers walk away.

It also shapes how people see your brand. A $15 candle and a $65 candle tell two completely different stories. Even if they smell the same. Price signals value, quality, and what kind of brand you are.

Your price decides where you stand in the market, too. Are you the affordable pick, the premium option, or somewhere in between? Once people see you a certain way, it’s hard to change that.

It even affects who buys from you. Lower prices can bring in more people, but they might not stick around. Higher prices can attract fewer buyers. But often the loyal kind.

And finally, your competitors notice. Price too low, and you risk starting a price war. Price is higher, and you’ve got to prove you’re worth it. In short, your price isn’t just a number. It’s your message.

Product Pricing Fundamentals

Before jumping into pricing strategies, let’s nail down the basics every decision depends on:

Cost floor: This is your base. The lowest price you can charge without losing money. It covers everything from materials and labor to shipping and fees. If you don’t know this number, you’re guessing.

Value ceiling: This is the highest price customers would reasonably pay based on how much they think your product is worth, not what it costs you. A 10¢ bottle of water could be worth $100 in the desert. That’s the power of perceived value.

Market rate: This is what similar products sell for right now. It’s your middle ground between cost and value. You can go higher if you offer more, or lower if you’re playing smart. But you need to know where you stand.

Profit margin: The gap between what it costs you and what you charge. It’s your reward for doing business. Margins vary. Retail sits around 30–50%, software can hit 80–90%, and restaurants often survive on just 3–5%. Know your industry’s norm.

How to Price a Product in 5 Steps

Pricing can feel like a guessing game, but it doesn’t have to be. Whether you’re launching something new or rethinking your current prices, having a clear process makes all the difference.

Let’s walk through a simple five-step method to help you find that sweet spot. Where your price covers costs, stays competitive, and still makes a healthy profit.

Step 1: Calculate All Your Costs

You can’t price intelligently without knowing what things actually cost. And I mean everything, not just the obvious stuff.

Fixed costs are expenses that don’t change with the amount you sell. These include:

- Rent for office, warehouse, or retail space

- Salaries and benefits for full-time employees

- Insurance (business, liability, property)

- Software subscriptions (accounting tools, email marketing, inventory systems)

- Equipment and machinery

- Website hosting and domain fees

- Marketing retainers or fixed advertising spend

Pick a time period. Monthly, quarterly, or annually. Add up all these costs for that period.

Example: Your monthly fixed costs might be:

Fixed Costs Calculator

Variable costs change based on production volume. They’re also called Cost of Goods Sold (COGS). These include:

- Raw materials and components

- Manufacturing or production labor

- Packaging materials

- Shipping and fulfillment

- Payment processing fees (typically 2-3% per transaction)

- Sales commissions

- Storage and warehousing fees

Example: For a physical product, your per-unit variable costs might be:

Variable Costs Calculator (Per Unit)

Calculate the cost per unit. If you’re selling multiple products, do this for each one.

(Total Fixed Costs + Total Variable Costs) ÷ Number of Units = Cost Per UnitBut here’s the catch: your fixed costs per unit change based on volume. If you produce 100 units, you’re spreading $12,000 in monthly costs across 100 units ($120 per unit). If you produce 1,000 units, it’s only $12 per unit.

Example with 500 units per month:

Total Cost Per Unit Calculator

This number, $41.75, is your break-even point. Charge less than this and you lose money on every sale.

Step 2: Research Your Market and Competitors

Now that you know your costs, it’s time to look outward. What’s actually happening in the market?

Identify direct competitors. These are businesses selling essentially the same thing you are. Same product category, same target customer, same price range. Make a list of 5-10 direct competitors.

Analyze their pricing. Don’t just look at the price tag. Look at the whole package:

- What’s their list price?

- Do they offer discounts? How often?

- What’s included (free shipping, warranties, support)?

- How do they bundle or tier their offerings?

- What payment options do they provide?

Study their positioning. How do they talk about their products? What benefits do they emphasize? Are they competing on price, quality, convenience, or something else?

Identify indirect competitors. These are alternative solutions to the same problem. If you sell meal kit subscriptions, restaurants, and grocery delivery services are indirect competitors.

They’re not the same product, but they’re competing for the same dinner time and food budget.

Find market gaps. Look for pricing opportunities:

- Is everyone clustered around the same price point? Maybe there’s room for a budget or premium option.

- Are competitors offering way more features than most customers need? You could offer less for less.

- Is everyone racing to the bottom on price? Quality and service might be an opening.

Talk to potential customers. Ask them:

- What would you expect to pay for something like this?

- At what price does this become too expensive to consider?

- At what price would you question the quality?

- What would make you pay more for this?

Step 3: Choose Your Pricing Strategy

Your strategy is the framework for how you’ll approach pricing. We’ll cover seven major strategies in detail later, but here’s how to choose:

Start with your positioning. Are you the budget option, the premium choice, or somewhere in between? Your pricing strategy should support this position.

Consider your business goals.

- Need market share quickly? Penetration pricing might work.

- Launching something innovative? Price skimming could maximize early profits.

- Selling commodities? Competitive pricing keeps you relevant.

- Have a clearly superior product? Value-based pricing captures that worth.

Think about your target customer.

- Price-sensitive customers respond to competitive or penetration pricing.

- Quality-focused buyers appreciate value-based or premium approaches.

- Convenience seekers may accept dynamic pricing.

- Business buyers often evaluate value differently from consumers.

Match your capacity.

- Limited production capacity? Higher prices with better margins make sense.

- High fixed costs that need volume? Lower prices to drive sales.

- Digital products with near-zero marginal costs? Flexibility to experiment.

Step 4: Calculate Your Price

Now let’s do the actual math. I’ll show you the most common approach: cost-plus pricing with a target margin.

The formula:

Selling Price = Cost Per Unit ÷ (1 - Desired Profit Margin as decimal)Selling Price Calculator

Compare to market research.

- Does $69.99 fit within the range customers expect?

- Is it competitive?

- If competitors are at $49.99 or $89.99, you need to adjust or clearly communicate why your pricing makes sense.

Industry benchmarks for profit margins:

- General retail: 25-50%

- Apparel: 40-60%

- Electronics: 30-40%

- Food and beverage: 25-40%

- Software/SaaS: 70-90%

- Services: 50-70%

Your margin doesn’t have to match these exactly, but if you’re wildly different, make sure you have a good reason.

Step 5: Test, Review, and Adjust

Pricing isn’t set in stone. It’s an ongoing process. Test different price points. If you can, run small experiments:

- Try $69.99 vs $74.99 on different channels or time periods

- Test $69 vs $69.99 to see if charm pricing matters for your audience

- Offer limited-time promotions to gauge price sensitivity

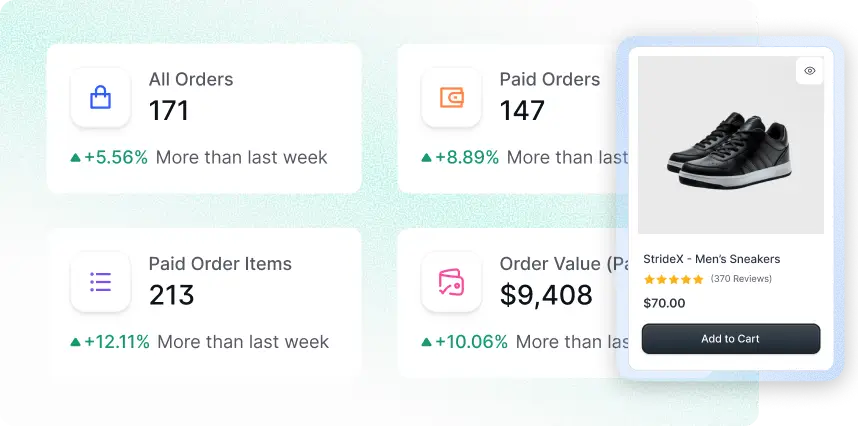

Monitor key metrics:

- Conversion rate (what percentage of visitors buy)

- Average order value

- Customer acquisition cost

- Profit margin per sale

- Customer lifetime value

Review regularly. Set calendar reminders:

- Monthly: Check sales velocity and margin

- Quarterly: Review competitor pricing

- Annually: Reassess full cost structure and strategy

Adjust when needed. Price changes aren’t betrayals. They’re business necessities. When costs increase, when you add value, when market conditions shift, adjust your pricing.

Just communicate changes clearly to customers and give existing customers consideration when possible.

7 Proven Product Pricing Strategies

Let’s dive deep into each major pricing strategy. These aren’t mutually exclusive. Many businesses combine elements from multiple approaches.

1. Cost-Plus Pricing

Calculate what it costs to make your product, then add a markup percentage for profit.

The formula:

Cost + (Cost × Markup Percentage) = PriceMarkup Price Calculator

Who should use it:

- Manufacturers with stable, predictable costs

- Businesses in established markets with standard margins

- Government contractors (often required to use it)

- Anyone starting who needs a simple baseline

|

Pros |

Cons |

|---|---|

|

|

Example: Many construction contractors use cost-plus. They calculate materials, labor, and overhead, then add a standard 20-30% markup. It’s transparent, defendable, and ensures they don’t lose money on projects.

When to avoid it: If your product has unique benefits that justify premium pricing, or if your market is highly competitive and customers shop purely on price.

2. Value-Based Pricing

Price is based on the perceived value to the customer, not your costs. You’re charging for outcomes and benefits, not inputs. Identify the problem you solve, quantify the value of solving it, and capture a portion of that value as your price.

Who should use it:

- SaaS and software companies

- Businesses with unique, differentiated products

- B2B services with measurable ROI

- Luxury or premium brands

|

Advantages |

Disadvantages |

|---|---|

|

|

Example: Salesforce doesn’t price based on server costs. They price based on the value of better sales pipeline management, increased close rates, and revenue growth. A small business might pay $25/user/month.

An enterprise pays $300/user/month for the same core product because the value to them is higher.

How to implement it:

- Research what problem you solve

- Quantify the impact (time saved, money earned, risk reduced)

- Survey customers on perceived value

- Set pricing at a fraction of the value delivered

- Communicate value clearly in marketing

3. Competitive Pricing

Set your prices based on what competitors charge. You might match them, undercut slightly, or position just above if you offer more.

The spectrum:

- Below market: 5-10% under competitors

- At market: Within 5% of competitor averages

- Above market: 10-20%+ over competitors

Who should use it:

- Businesses in commodity markets

- New entrants are trying to gain share

- Companies without clear differentiation

- Retailers in competitive categories

|

Advantages |

Disadvantages |

|---|---|

|

|

Example: Gas stations use competitive pricing religiously. Drive down any highway and you’ll see stations matching each other within pennies. They’re selling the same commodity, so price becomes the primary differentiator.

Pro tip: Don’t compete on price alone if you can help it. Use competitive pricing as a baseline, then differentiate on service, quality, convenience, or experience. Starbucks charges 2-3x what basic coffee shops charge, but they’ve built value beyond the coffee itself.

4. Penetration Pricing

Launch with intentionally low prices to quickly gain market share and customers, then gradually increase prices over time. The strategy can be:

- Phase 1: Low prices to attract early adopters

- Phase 2: Build customer base and brand recognition

- Phase 3: Raise prices as value is proven

Who should use it:

- New market entrants are facing established competitors

- Products with network effects (more users = more value)

- Businesses that benefit from scale

- Companies with low marginal costs

|

Advantages |

Disadvantages |

|---|---|

|

|

Example: Spotify used penetration pricing masterfully.

They offer extremely cheap trials ($0.99 for 3 months) and student pricing ($4.99/month) to build a massive user base. Once people built playlists and habits, most converted to full price ($10.99/month). The initial low margin was an investment in long-term subscribers.

Critical warning: Only use this if you have the capital to sustain losses initially and a clear path to profitability. Many startups have burned through cash with penetration pricing and couldn’t raise prices fast enough to survive.

5. Price Skimming

Launch at a high price to maximize profit from early adopters, then gradually lower prices to reach broader markets. The progression can be launched at a Premium price for innovators. After 6-12 months, reduce the price for the early majority.

After 12-24 months, you can further reductions for the mass market. And after that, Value pricing for late adopters.

Who should use it:

- Companies with innovative, first-to-market products

- Tech companies with rapid product cycles

- Businesses targeting multiple market segments

- Products with short shelf life or fashion cycles

|

Advantages |

Disadvantages |

|---|---|

|

|

Example: Apple is the master of price skimming. New iPhones launch at premium prices. Early adopters gladly pay $1,200. A year later, that model drops to $800.

Two years later, it’s $500. Meanwhile, Apple has launched a new flagship at $1,200+, and the cycle repeats. Each price tier targets a different segment.

When to avoid it: If competitors can quickly copy your product or if you’re in a mature, commoditized market.

6. Dynamic Pricing

Prices fluctuate in real-time based on demand, supply, competition, time, or customer segment. Common triggers:

- Demand: Higher prices when demand spikes

- Time: Peak vs off-peak pricing

- Inventory: Lower prices for excess stock

- Customer: Personalized pricing based on behavior

- Competition: Real-time matching or undercutting

Who should use it:

- Businesses with perishable inventory (hotels, airlines, events)

- Services with fluctuating demand (ride-sharing, delivery)

- E-commerce with real-time competitor data

- Digital products with minimal marginal cost

|

Advantages |

Disadvantages |

|---|---|

|

|

Example: Amazon changes prices millions of times per day. A product might be $47.99 at 9 am, $43.99 at 2 pm, and $52.99 at 8 pm based on competitor prices, stock levels, and demand patterns. Most customers never notice.

Implementation tip: If you use dynamic pricing, be transparent about why prices change (demand, availability, timing) rather than making it feel arbitrary or manipulative.

7. Bundle Pricing

Offer multiple products or services together at a lower combined price than buying them separately. Types of bundles:

- Pure bundling: Only available as a bundle, can’t buy separately

- Mixed bundling: Available both bundled and separately

- Cross-product bundling: Complementary items bundled together

- Same-product bundling: Multiple quantities at a discount

Who should use it:

- Businesses with multiple complementary products

- Companies are trying to move slow-moving inventory

- SaaS offering tiered service packages

- Retailers are increasing the average transaction size

|

Advantages |

Disadvantages |

|---|---|

|

|

Example: Microsoft Office bundles Word, Excel, PowerPoint, Outlook, and other apps. You could pay $7-10/month per app, or $10/month for the entire Office 365 suite.

The bundle is so compelling that few people buy apps individually. Microsoft moves more customers to full suites, even if the margin per app is lower.

Strategy tip: Bundle your bestseller with slower-moving products. The popular item drives the sale, and you move the inventory that might otherwise sit.

Pricing Psychology

How you present prices matters as much as the actual numbers. Understanding pricing psychology can increase conversions by 20-30% without changing your actual price.

Charm Pricing: The Power of .99

$19.99 and $20.00 differ by one cent, yet feel dramatically different. This happens because we read left to right and anchor on the first digit (19 versus 20). And .99 signals a deal or value pricing. More concisely, it feels like “teens” versus “twenties”

Studies show charm pricing can increase sales by 8-12%.

When to use it:

- Mass-market products

- Value positioning

- E-commerce and retail

- Products under $100

Prestige Pricing

For luxury and premium products, round numbers signal quality and exclusivity. The absence of .99 says we’re not about discounts. Prestigious pricing also includes:

- Removing dollar signs: “25” instead of “$25” on menus

- Pricing deliberately very high to signal exclusivity

- Limited availability messaging

In prestige pricing, price says quality. A $200 moisturizer signals luxury ingredients, research, and efficacy. The same product at $19.99 would raise quality concerns. Sometimes, higher prices sell better than lower ones in premium categories.

Price Anchoring

The first price customers see becomes an anchor that influences how they judge subsequent prices. Showing a higher “original” price makes your actual price feel like a bargain.

Tactics:

- Strike-through pricing: ~~$129~~ $89 (save $40!)

- Compare to alternatives: “Other solutions cost $5,000. Ours is just $1,200.”

- Show premium option first: Make the standard option feel reasonable

Decoy pricing

Offer three tiers where the middle option is designed to make the premium option look attractive:

- Basic: $30 (limited features)

- Standard: $50 (good features)

- Premium: $55 (everything in Standard + bonus features)

The Standard and Premium prices are close, making Premium feel like a no-brainer upgrade. Even though you’d prefer selling Premium at $55 all along.

Multiple Price Points: The Goldilocks Effect

When presented with three options, most people choose the middle one. They avoid the cheapest (concerns about quality) and the most expensive (seems excessive), landing on “just right.”

Structure offers a strategic approach for a Consultation Service:

- Basic: 30-minute call – $150

- Standard: 60-minute call + written summary – $400

- Premium: 90-minute call + written plan + email support – $750

Most clients choose Standard at $400. But without Basic, they might have chosen a cheaper option elsewhere. Without Premium, Standard doesn’t feel as reasonable.

The Power of “Free”

The word “free” triggers powerful psychological responses. People overvalue free items and are drawn to “free” offers even when the math doesn’t favor them.

Strategic uses:

- Free shipping thresholds: “Free shipping on orders over $50”. If the average order value is $42, this encourages customers to add $8+ in products. It increases your revenue while the “free shipping” (already built into your pricing) feels like a bonus.

- Free bonus with purchase: “Buy 2, get 1 free” performs better than “33% off” even though they’re mathematically identical.

- Free trial or sample: Digital products with free trials convert 5x better than those without. The commitment to try feels low-risk, but usage creates commitment.

The zero price effect:

Experiments show people will wait in long lines for a free $0.01 item they wouldn’t buy for $0.01. Free isn’t just a low price. It’s psychologically unique.

Split Pricing

Break a large price into smaller amounts.

Techniques:

- Annual to monthly: $1,200/year → $100/month

- Daily breakdown: “$99/month” → “Less than $3.30/day”

- Per-use: “$500 license” → “$0.50 per transaction”

- Payment plans: $2,000 upfront → $200/month for 10 months

It works because small numbers are less intimidating. Compare to familiar daily expenses.

Example: Gyms never say “$360/year.” Always “$30/month” or “$1/day for your health.”

Once In a Lifetime Offer

Mistakes to avoid

Pricing Too Low: Trying to be the cheapest attracts bargain hunters, kills margins, and devalues your brand. To solve that, compete on value, better quality, service, or story. Not just price. Show why you’re worth more.

Ignoring Hidden Costs: If you don’t count overhead, labor, or fees, you’ll think you’re profitable when you’re not. List every expense. Count every single cost of materials, time, rent, returns, and fees. Know your real minimum price.

Only Using Cost-Based Pricing: Cost-plus pricing ignores market value and customer perception. Use costs as your floor, then price based on customer value, demand, and competition.

Copying Competitors: You don’t know their costs or strategy. Matching blindly can hurt you. Study competitors, but price intentionally based on your strengths and goals.

Same Margin for Every Product: Not all items deserve the same profit margin. Adjust margins by product type. Use lower margins for traffic drivers, higher ones for add-ons.

Never Updating Prices: Costs, markets, and value change. But your price doesn’t. Review pricing quarterly. Adjust for inflation, demand, and product improvements.

One Price for Everyone: Different customers have different budgets and needs. Use tiers like budget, mid-range, and premium. So each segment finds a fit.

Pricing on Gut Feeling: What feels right isn’t data. You’ll likely underprice. Base prices on costs, competitor research, and customer feedback.

Skipping Price Tests: Guessing before launch risks losing revenue or low sales. Test prices with small audiences, A/B experiments, or surveys to find the sweet spot.

Ignoring Psychology: People buy with emotions, not math. Use charm pricing ($19.99), anchoring ($100 → $70), and clear tiers to guide choices.

Frequently Asked Questions

Q1. What’s a good profit margin?

Answer: Any positive margin is better than none, but aim for:

- Retail physical products: 30-50%

- Digital products: 70-90%

- Services: 50-70%

- Food/beverage: 25-40%

According to NYU Stern School of Business data, these are industry averages. Higher margins give you more room for marketing, growth, and weathering market changes.

Q2. Can I raise prices on existing customers?

Answer: Yes, but communicate clearly:

- Give advance notice (30-60 days)

- Explain why (costs, added value)

- Consider grandfathering loyal customers

- Show what they’re getting for the increase

Most customers accept reasonable increases if you’re transparent.

Q3. Should I offer discounts?

Answer: Strategic discounts work: seasonal sales, new customer acquisition, and inventory clearance. Avoid constant discounting, which trains customers to wait for sales and devalues your brand. If you discount, make it time-limited and genuine.

Conclusion: Your Path to Profitable Pricing

Pricing isn’t a one-time decision. It’s an evolving strategy that grows with your business.

Start with the fundamentals. Know your costs, understand your market, calculate a baseline price. Then layer in strategy. Choose an approach that matches your positioning and goals. Add psychological elements that influence customer perception and decision-making.

The most important thing? Start somewhere. Don’t let pricing paralysis stop you from launching. Begin with cost-plus pricing to ensure profitability, then test and refine based on real customer feedback and sales data.

Your first price probably won’t be perfect. That’s okay. You’ll learn more from being in the market than from endless planning. Price confidently, deliver exceptional value, monitor results, and adjust.

Remember: a 1% improvement in pricing can mean an 11% boost in profits. Small tweaks compound over time. Keep testing, keep learning, keep optimizing.

Now go price your product and start selling.

Once In a Lifetime Offer

Leave a Reply