What Is Contribution Margin? A Simple Guide to Profitability

Contribution margin shows exactly how much money from each sale remains after paying for everything directly tied to making or delivering that product. It’s the metric that tells you whether you’re building something sustainable or just spinning your wheels.

This guide breaks down contribution margin with real numbers, practical examples, and strategies that work. You’ll learn how to calculate it, interpret the results, and use it to make better business decisions.

TL;DR

- Contribution margin shows how much money remains from each sale after variable costs.

- It reveals which products, channels, and customers generate real profit.

- Use it for pricing, break-even analysis, product mix, and business decisions.

- Tracking and improving it even slightly can significantly increase profits.

What Is Contribution Margin?

Contribution margin is the amount of revenue remaining after subtracting all variable costs associated with producing or delivering a product. It represents the portion of sales revenue that contributes toward covering fixed costs and generating profit.

Every dollar of contribution margin goes toward paying fixed expenses like rent, salaries, insurance, and equipment. Once those fixed costs are covered, every additional dollar becomes pure profit.

Why It Matters More Than Revenue

Revenue tells you how much you sold. Profit tells you what remains after everything. But contribution margin tells you whether your business model actually works.

Industry benchmarks verified:

- Bean Ninjas reports that “eCommerce contribution margins typically fall between 35-75%, with anything above 50% considered strong.”

- “Manufacturing businesses typically target 30-40%”, according to CFO Consulting Partners research.

- “Software companies routinely achieve 70-85% margins because their variable costs consist mainly of server hosting and customer support.”

Understanding contribution margin helps you identify which products drive the most value, set prices with confidence, allocate resources strategically, plan for growth with accurate break-even analysis, and make informed decisions about channels and customer segments.

How to Calculate Contribution Margin

The formula looks simple, but requires careful thinking:

Contribution Margin (dollars) = Revenue – Variable Costs

Contribution Margin (percentage %) = (Revenue – Variable Costs) ÷ Revenue × 100

1. Variable vs. Fixed Costs

Variable costs scale directly with sales volume. Make one unit, incur one unit of cost. Make 1,000 units, multiply that cost by 1,000.

Variable costs include raw materials, production labor paid per unit, packaging materials, shipping charges, payment processing fees, and sales commissions tied to individual transactions.

Fixed costs stay constant regardless of sales volume. Rent, salaried employees, software subscriptions, insurance premiums, and equipment leases don’t change based on monthly sales.

2. Simple Calculation Example

A candle maker sells handcrafted soy candles for $28 each. Variable costs total $14.50 per candle, including wax ($3.80), fragrance ($2.20), container ($1.90), wick ($0.30), packaging ($1.50), and shipping ($4.80).

That leaves $13.50 in contribution margin, representing a 48% margin rate.

She needs $4,200 monthly for fixed costs. At $13.50 contribution per candle, she must sell 312 candles per month just to break even. Every candle beyond that becomes actual profit.

Contribution Margin vs. Gross Profit Margin

While related, these measure different things. Gross Profit Margin typically excludes certain variable costs like shipping, payment processing, and commissions that the contribution margin includes.

Contribution Margin gives you a clearer picture of true product profitability because it accounts for all costs that vary with each sale, making it more useful for operational decision-making.

Industry Benchmarks You Need to Know

Different industries operate on completely different margin structures:

- Manufacturing: “30-40% contribution margins need to cover substantial fixed costs like equipment, facilities, and full-time labor forces.”

- Software/SaaS: “70-85% margins because variable costs consist mainly of server hosting and customer support. Industry studies show 70% of surveyed SaaS companies had gross margins of 70% or more, with top performers exceeding 80%.”

- eCommerce: “35-75% margins, with anything above 50% considered strong. Bean Ninjas research shows healthy eCommerce contribution margins fall within this range. Shopify sellers typically achieve net profit margins between 10-20%, while Amazon sellers average 5-15% due to platform fees.”

- Restaurants: “60-70% margins on high-performing menu items work well when overall food cost targets stay around 28-35% of revenue.”

- Professional Services: “Depending on the industry and project scope, gross margins after contractor and project-specific costs usually range between 15–30%.”

Understanding where your business fits helps set realistic targets and identify improvement opportunities.

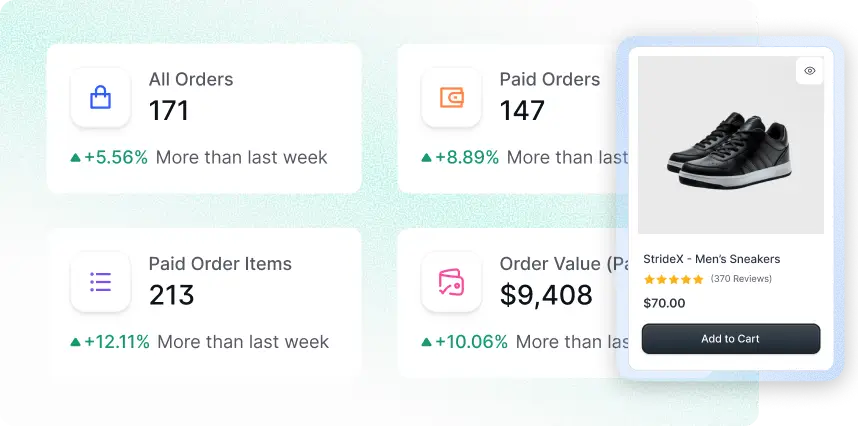

Strategic Applications That Drive Profit

Product mix decisions matter. A fitness equipment retailer discovered their yoga mats had 35% margins, resistance bands hit 66%, and foam rollers reached 52%. But dollars matter too.

Foam rollers generated $29 per sale versus $21 for resistance bands. Fixed costs don’t care about percentages. They need actual dollars.

The strategy became clear: resistance bands work perfectly as entry-level products and email promotions because high margins mean discounts still maintain profitability. Foam rollers become hero products for general marketing because they generate the most contribution dollars per transaction.

1. Multi-Channel Economics

A watch retailer sells the same $180 product on their website (51% margin) and Amazon (32% margin). The Amazon channel contributes $33 less per watch sold.

But Amazon drives volume the website alone cannot match. The retailer sells 50 watches monthly through their website but 180 through Amazon.

Website contribution: $4,550 monthly. Amazon contribution: $10,440 monthly.

Lower margin, higher volume, more total dollars toward fixed costs and profit. They know Amazon works as a volume channel but shouldn’t be their only channel. Website sales deliver better margins and deserve continued investment.

2. Break-Even Analysis in Practice

A barbecue food truck in Austin sells three items. Brisket plates contribute $9 per plate, pulled pork contributes $7.30, and loaded nachos contribute $5.70.

Daily fixed costs total $320. To break even selling only brisket requires 36 plates daily. Selling only pork needs 44 plates.

The owner adjusted the menu board to make brisket the visual centerpiece. Brisket sales increased from 40% to 55% of total orders. Daily sales remained at 90 plates, but the mix shift added $3,960 in monthly profit.

Service Business Applications

A digital marketing agency offers three tiers. Basic packages contribute $930 (42% margin), growth packages contribute $2,600 (47% margin), and enterprise packages contribute $6,270 (52% margin).

All three require similar account management time from salaried staff. The strategy becomes obvious: focus sales efforts on growth and enterprise clients. These packages generate 2.8 times and 6.7 times more contribution dollars while consuming similar fixed resources.

Over 12 months, their client mix shifted from 65% basic to 35% basic. Total monthly contribution dollars increased from $48,000 to $71,000 on similar revenue levels, directly translating to $23,000 additional monthly profit.

Evaluating Business Investments

A beauty products store generates $85,000 monthly with a 58% contribution margin. That means $49,300 in contribution dollars. Operating expenses total $39,500, leaving $9,800 profit.

The owner wants to hire a customer service representative at $3,200 monthly. The business can afford it, but should they?

The better question: will the representative increase sales enough to justify the cost? If improved customer experience increases monthly revenue by just $5,520 (assuming the 58% margin holds), the new position pays for itself. Anything beyond becomes pure profit growth.

Equipment Investment Analysis

A furniture manufacturer considers purchasing a CNC machine for $180,000 that would reduce variable costs on their top-selling table from $240 to $195 per unit. They sell 160 tables monthly at $520 each.

Monthly impact: 160 tables × $45 additional contribution = $7,200 extra margin.

The machine pays for itself in 25 months. That $7,200 monthly improvement means $86,400 annually. Over the machine’s 10-year useful life, that’s $864,000 in added profit.

The improved contribution margin also creates capacity for growth. The manufacturer can now afford an additional sales representative and still increase profit while expanding market reach.

When Contribution Margin Reveals Hidden Problems

A boutique clothing store dedicated 60% of floor space to designer dresses at $240 with 22% margins. Casual wear at $68 had 46% margins but less space.

Monthly sales: 85 designer dresses and 110 casual pieces. Total contribution: $7,065. Fixed costs: $18,000 monthly.

The store lost $10,935 monthly. Designer dresses, despite higher prices, contributed barely more dollars than casual wear due to terrible margins.

After shifting to 70% casual wear and negotiating better wholesale pricing on designer pieces, total contribution reached $10,150. The boutique achieved profitability.

Optimizing Your Contribution Margin

An outdoor gear company sold backpacks for $120 with 43% margins.

They implemented three changes:

- Negotiated manufacturing costs down by $4

- Optimized packaging to save $2.50 on shipping

- Switched payment processors to save $0.60 per transaction.

New margin: 48%. That 5-percentage-point improvement generated an extra $7.10 per backpack. At 420 monthly sales, that’s $2,982 additional monthly profit, or $35,784 annually. These optimizations required no price increases and no reduction in quality.

A 2-3% improvement in contribution margin might seem modest. On $500,000 in annual revenue, that’s $10,000 to $15,000 in additional profit. On $2 million in revenue, it’s $40,000 to $60,000.

eCommerce-Specific Considerations

eCommerce businesses face unique pressures: shipping costs (target 10-15% of revenue), payment processing fees (typically 1.5-3.5% per transaction), returns management, and advertising costs ranging from 20-33% of revenue.

Every percentage point matters when margins face this much pressure.

1. Technology Infrastructure Matters

Platform choice compounds these effects over time. Systems built for efficiency reduce variable costs per transaction. Streamlined inventory management prevents stockouts that lose sales and overstocks that tie up capital.

Smart eCommerce operators test shipping carriers quarterly and review payment processing agreements annually. They optimize product photography to reduce returns, which destroys contribution margin twice: once shipping out, again processing the return, and restocking.

2. How Platform Fees Erode Margins

FluentCart approaches eCommerce infrastructure differently. Rather than layering fees on top of fees, it provides WordPress users with complete control over their margins. 0% transaction fees are bleeding away profits with each sale from your eCommerce system itself. No forced upgrades to access basic features. Also, no monthly extra costs that scale disproportionately with success.

For businesses serious about profitability, the math is simple. Every dollar saved on platform fees and operational inefficiency is a dollar added to contribution margin.

Common Mistakes to Avoid

- Focusing only on percentages: A 70% margin on a $10 product generates less contribution than a 40% margin on a $100 product. Dollars fund your business, not percentages.

- Ignoring customer lifetime value: A subscription box with 44% margin seems mediocre until you realize customers stay 14 months, generating $280 total contribution versus a $38 acquisition cost.

- Misclassifying costs: Labor that scales with volume is variable. Labor that stays constant is fixed. Getting this wrong makes your margin calculations meaningless.

- Not tracking by segment: Your overall contribution margin means nothing if half your products have 70% margins and half have 15% margins. Track by product, channel, and customer type.

Wrapping Up

Contribution margin separates businesses that understand their economics from those that don’t. Revenue tells you how much you sold. Profit tells you what remains after everything. Contribution margin tells you whether your business model actually works.

Track it by product. Track it by channel. Track it by customer segment. The patterns reveal which decisions build value and which destroy it. Your contribution margin doesn’t lie. It shows exactly where profit comes from and where it disappears.

Calculate yours today. Compare it against industry benchmarks. Then start optimizing. Even small improvements in contribution margin create substantial profit gains over time. That’s how sustainable businesses get built.

Leave a Reply